Transcontinental Inc. announces its results for fiscal 2019

Highlights

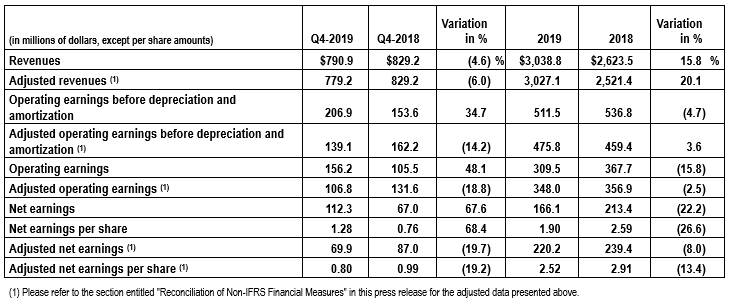

- Revenues of $3,038.8 million for fiscal 2019, the highest in the company's history, up 15.8% compared to 2018.

- Adjusted revenues(1) of $3,027.1 million for fiscal 2019, up 20.1% compared to 2018.

- Adjusted operating earnings before depreciation and amortization(1) of $475.8 million, up 3.6%.

- Operating earnings of $309.5 million, down 15.8%.

- Adjusted operating earnings(1) of $348.0 million, down 2.5%.

- Net earnings of $166.1 million ($1.90 per share) for fiscal 2019 compared to $213.4 million ($2.59 per share) for 2018.

- Adjusted net earnings(1) of $220.2 million ($2.52 per share) for fiscal 2019 compared to $239.4 million ($2.91 per share) for 2018.

- Cash flows from operating activities of $431.6 million, up 38.1%.

- Sold the Fremont, California building to Hearst for US$75 million (approximately C$100 million).

- Sold specialty media assets and event planning activities to Contex Group Inc. and Newcom Media Inc.

- Acquired Holland & Crosby Limited, a manufacturing company specialized in in-store marketing product printing.

- On November 27, 2019, announced it entered into a definitive agreement to sell its paper and woven polypropylene packaging operations to Hood Packaging Corporation for a price of US$180 million (approximately C$239 million) subject to working capital adjustments and regulatory approvals.

(1)Please refer to the section entitled "Non-IFRS Financial Measures" in this press release for a definition of these measures.

Montréal, December 12, 2019 - Transcontinental Inc. (TSX: TCL.A TCL.B) announces its results for the fourth quarter and fiscal 2019, which ended October 27, 2019.

"2019 was marked by the successful integration of Coveris Americas, a turning point in our transformation, said François Olivier, President and Chief Executive Officer of TC Transcontinental. In only two years, we grew our revenues by 50% to reach more than $3 billion in 2019, a first in our company’s history. We executed on our growth strategy and rigorously managed risk. I am very pleased with our company's evolution in positioning us to create long-term value.

"In our Packaging Sector, in accordance with our plan, we increased our operating earnings margin before depreciation and amortization quarter after quarter during the fiscal year, thanks to realized synergies and efficiency gains. We are building the foundations needed to generate long-term sustainable organic growth and remain committed to improving profitability in the coming years. We are well positioned and our portfolio of products and services will continue to evolve in line with our strategy to focus on markets where we have a lasting competitive advantage.

"In our Printing Sector, we experienced a difficult year overall, marked by the greater than expected decline in our revenues from retailer-related services. Despite the circumstances, we once again recorded an excellent operating earnings margin before depreciation and amortization and strong cash flows. In addition, we implemented cost management measures to help mitigate these impacts. In the coming years, we will continue optimizing our printing platform and seize growth opportunities in certain promising verticals, such as book printing and in-store marketing products.

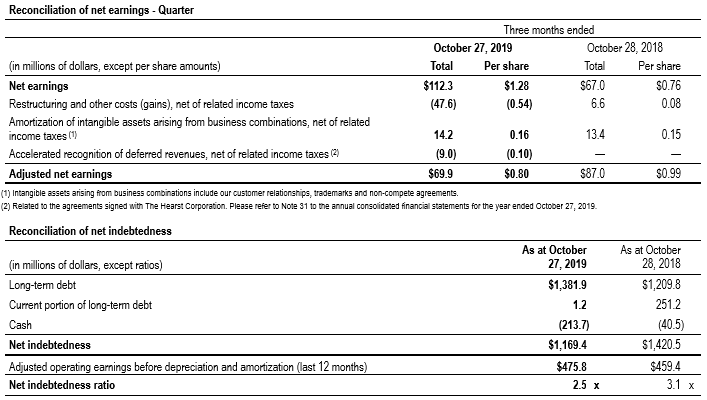

"Despite the challenges we faced in the Printing Sector, we generated cash flows from operating activities of over $430 million, up 38.1% compared to the previous fiscal year, which were mainly used to reduce our net indebtedness, as per our plan. Finally, I am confident that the Publisac will continue to play an important role in the years ahead. We are committed to defending the interests of the Publisac and of all its stakeholders, namely the thousands of employees who are part of the production and distribution process everywhere across Québec, merchants, local newspaper publishers as well as the millions of citizens who benefit from it every week. We remain convinced that the situation will result in a positive outcome."

Financial Highlights

Fiscal 2019 Results

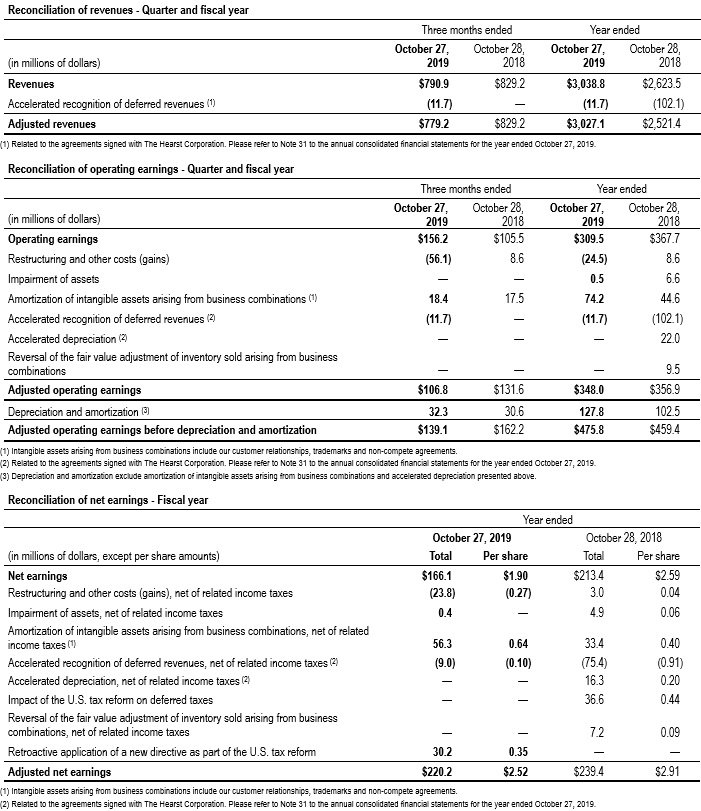

Revenues increased by $415.3 million, or 15.8%, from $2,623.5 million in fiscal 2018 to $3,038.8 million in fiscal 2019. This increase is essentially attributable to acquisitions, in particular that of Coveris Americas, which contributed $643.4 million to revenues. It was mitigated by the impact of the accelerated recognition of deferred revenues recorded in 2018 in the Printing Sector, the decrease in volume in the Printing Sector as well as the effect of the sale of the California newspaper printing operations.

Operating earnings decreased by $58.2 million, or 15.8%, from $367.7 million in fiscal 2018 to $309.5 million in the corresponding period in 2019. This decrease is mainly due to the accelerated recognition in 2018 of deferred revenues of $102.1 million, net of accelerated depreciation of $22.0 million. The decline in Printing Sector revenues and workforce reduction costs also contributed to the decrease in operating earnings. This change was partially offset by the impact of the acquisition of Coveris Americas and the gain on sale of assets resulting from the sale of the Fremont, California building to Hearst. Adjusted operating earnings decreased by $8.9 million, or 2.5%, from $356.9 million to $348.0 million.

Net earnings decreased by $47.3 million, or 22.2%, from $213.4 million in fiscal 2018 to $166.1 million in fiscal 2019. This decrease is due to the previously explained decline in operating earnings as well as higher financial expenses, partially offset by a decrease in income tax expense. On a per share basis, net earnings went from $2.59 to $1.90 due to the above-mentioned items, but also to the effect of the issuance of 10.8 million Class A Subordinate Voting Shares of the Corporation in May 2018.

Adjusted net earnings decreased by $19.2 million, or 8.0%, from $239.4 million in fiscal 2018 to $220.2 million in fiscal 2019, mostly as a result of higher financial expenses and lower adjusted operating earnings, partially offset by the decrease in adjusted income tax expense. On a per share basis, adjusted net earnings went from $2.91 to $2.52, mainly due to the decrease in adjusted net earnings and, to a lesser extent, to the effect of the issuance of 10.8 million Class A Subordinate Voting Shares of the Corporation in May 2018.

2019 Fourth Quarter Results

Revenues decreased by $38.3 million, or 4.6%, from $829.2 million in the fourth quarter of 2018 to $790.9 million in the corresponding period of 2019. This decrease is essentially related to a decline in revenues of the Printing Sector and, to a lesser extent, of the Packaging Sector. In the Printing Sector, the decline is mainly explained by lower volume in our retailer-related service offering and, to a lesser extent, the end of transition services related to the Hearst transaction. The decrease in revenues for the quarter was partially offset by the accelerated recognition of deferred revenues in relation to the sale of the Fremont, California building to Hearst.

Operating earnings increased by $50.7 million, or 48.1%, from $105.5 million in the fourth quarter of 2018 to $156.2 million in the fourth quarter of 2019. This increase is mainly attributable to the change in restructuring and other costs (gains), primarily due to the gain on sale of assets, combined with the effect of the accelerated recognition of deferred revenues of $11.7 million in relation with the sale of the Fremont, California building to Hearst and, to a lesser extent, the increase in the Packaging Sector's operating earnings. This increase was partially offset by the decline in the Printing Sector operating earnings as well as the $10.9 million unfavourable effect of the stock-based compensation expense as a result of the change in the share price in the fourth quarter of 2019 compared to the corresponding period in 2018. Adjusted operating earnings decreased by $24.8 million, or 18.8%, from $131.6 million to $106.8 million.

Net earnings increased by $45.3 million, or 67.6%, from $67.0 million in the fourth quarter of 2018 to $112.3 million in the fourth quarter of 2019. This increase is mainly attributable to the previously explained increase in operating earnings. On a per share basis, net earnings went from $0.76 to $1.28.

Adjusted net earnings decreased by $17.1 million, or 19.7%, from $87.0 million in the fourth quarter of 2018 to $69.9 million in the fourth quarter of 2019. This decrease is mainly due to lower adjusted operating earnings in 2019 compared to the corresponding period in 2018. On a per share basis, adjusted net earnings went from $0.99 to $0.80.

For more detailed financial information, please see the Management’s Discussion and Analysis for the year ended October 27, 2019 as well as the financial statements in the “Investors” section of our website at www.tc.tc

Outlook

In the Packaging Sector, we expect a decrease in revenues in fiscal 2020 as a result of the definitive agreement to sell the paper and woven polypropylene packaging operations, which generated revenues of about US$215 million (approximately C$286 million) in fiscal 2019. With respect to organic growth, we expect a slight increase in the majority of our other verticals. We will continue to focus on profit margins and the achievement of synergies, which should have a positive impact on operating earnings. To support our customers and strengthen our position in the packaging industry, we will also continue to invest in the research and development of innovative and eco-responsible products. Lastly, by signing long-term contracts with major customers and developing business opportunities, we are building solid foundations for the company's growth.

In the Printing Sector, we expect that the organic decline will continue to affect the majority of our verticals, excluding book printing and in-store marketing products. The acquisition of Holland & Crosby Limited will help partially offset this organic decline. Lastly, our operational efficiency initiatives will have a positive impact in fiscal 2020, which should mitigate the effect of the decrease in volume on operating earnings.

We expect that the Media Sector will continue to record a good performance in the coming quarters in terms of profitability.

To conclude, we expect to continue generating significant cash flows from all our operating activities, which will enable us to reduce our net indebtedness and continue our transformation through targeted acquisitions in line with our strategy.

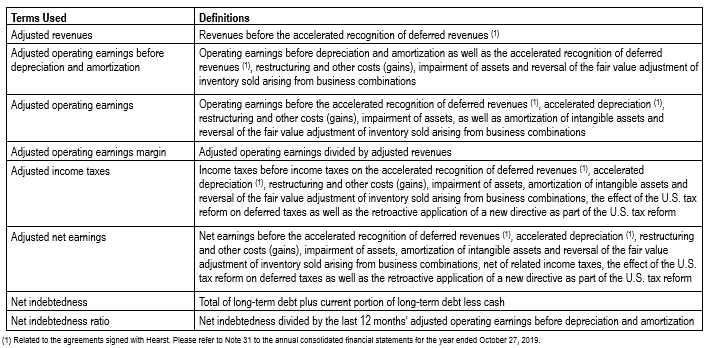

Non-IFRS Financial Measures

In this document, unless otherwise indicated, all financial data are prepared in accordance with International Financial Reporting Standards (IFRS) and the term "dollar", as well as the symbol "$" designate Canadian dollars.

In addition, in this press release, we also use non-IFRS financial measures for which a complete definition is presented below and for which a reconciliation to financial information in accordance with IFRS is presented in the section entitled "Reconciliation of Non-IFRS Financial Measures" and in Note 3, "Segmented Information", to the annual consolidated financial statements for the year ended October 27, 2019.

Reconciliation of Non-IFRS Financial Measures

The financial information has been prepared in accordance with IFRS. However, financial measures used, namely adjusted revenues, adjusted operating earnings before depreciation and amortization, adjusted operating earnings, adjusted operating earnings margin, adjusted income taxes, adjusted net earnings, adjusted net earnings per share, net indebtedness and net indebtedness ratio, for which a reconciliation is presented in the following table, do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many of our readers analyze the financial performance of the Corporation’s activities based on these non-IFRS financial measures as such measures may allow for easier comparisons between periods. These measures should be considered as a complement to financial performance measures in accordance with IFRS. They do not substitute and are not superior to them.

We also believe that adjusted revenues, adjusted operating earnings before depreciation and amortization, adjusted operating earnings and adjusted net earnings are useful indicators of the performance of our operations. Furthermore, management also uses some of these non-IFRS financial measures to assess the performance of its activities and managers.

Regarding net indebtedness and net indebtedness ratio, we believe that these indicators are useful to measure the Corporation’s financial leverage and ability to meet its financial obligations.

Dividend

The Corporation's Board of Directors declared a quarterly dividend of $0.22 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on January 22, 2020 to shareholders of record at the close of business on January 6, 2020.

Conference Call

Upon releasing its fourth quarter and fiscal 2019 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation’s website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514 954-3581.

Profile

TC Transcontinental is a leader in flexible packaging in North America, and Canada’s largest printer. The Corporation is also positioned as the leading Canadian French-language educational publishing group. For over 40 years, TC Transcontinental's mission has been to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are the strong values held by the Corporation and its employees. TC Transcontinental's commitment to its stakeholders is to pursue its business activities in a responsible manner.

Transcontinental Inc. (TSX: TCL.A TCL.B), known as TC Transcontinental, has over 9,000 employees, the majority of which are based in Canada, the United States and Latin America. TC Transcontinental had revenues of more than C$3.0 billion for the fiscal year ended October 27, 2019. For more information, visit TC Transcontinental's website at www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital at a reasonable rate, bad debts from certain customers, import and export controls, raw materials and transportation costs, competition, the Corporation's ability to generate organic growth in its Packaging Sector, the Corporation's ability to identify and engage in strategic transactions and effectively integrate acquisitions into its activities without affecting its growth and its profitability, while achieving the expected synergies, the political and social environment as well as regulatory and legislative changes, in particular with regard to the environment and door-to-door distribution, changes in consumption habits related, in particular, to issues involving sustainable development and the use of certain products or services such as door-to-door distribution, the impact of digital product development and adoption on the demand for retailer-related services and other printed products, change in consumption habits or loss of a major customer, the impact of customer consolidation, the safety and quality of its packaging products used in the food industry, innovation of its offering, the protection of its intellectual property rights, concentration of its sales in certain segments, cybersecurity and data protection, the inability to maintain or improve operational efficiency and avoid disruptions that could affect its ability to meet deadlines, recruiting and retaining qualified personnel in certain geographic areas and industry sectors, taxation, interest rates and indebtedness level. The main risks, uncertainties and factors that could influence actual results are described in the Management's Discussion and Analysis for the year ended October 27, 2019 and in the latest Annual Information Form.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of non-recurring or other unusual items, nor of disposals, business combinations, mergers or acquisitions which may be announced or entered into after the date of December 12, 2019.

The forward-looking statements in this press release are made pursuant to the “safe harbour” provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at December 12, 2019. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

– 30 –

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone: 514-954-3581

nathalie.st-jean@tc.tc

www.tc.tc

Financial Community

Yan Lapointe

Director, Investor Relations

TC Transcontinental

Telephone: 514-954-3574

yan.lapointe@tc.tc

www.tc.tc