Transcontinental Inc.: increased profitability in third quarter

Highlights

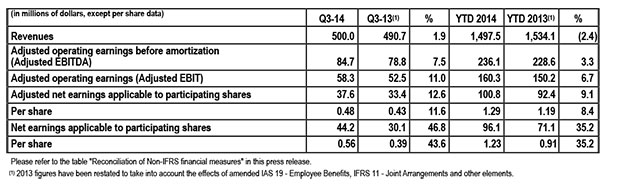

- Revenues increased 1.9%, primarily due to the contribution from acquisitions and new printing and distribution agreements, partially offset by the soft advertising market.

- Adjusted net earnings applicable to participating shares grew 12.6%, from $33.4 million to $37.6 million. On a per share basis, they rose from $0.43 to $0.48.

- Completed the acquisition of the assets of Capri Packaging, a supplier of flexible packaging solutions.

- Completed the acquisition of the Sun Media Corporation weekly newspapers in Quebec and their related Web properties.

- Signed a multi-year agreement with Postmedia Network Inc. to print The Gazette newspaper. The agreement took effect in August 2014.

- Announced the redemption of all outstanding Cumulative 5-Year Rate Reset First Preferred Shares, Series D, on October 15, 2014, for an aggregate total of $100 million.

- Closed a private financing agreement of $250 million in senior unsecured notes.

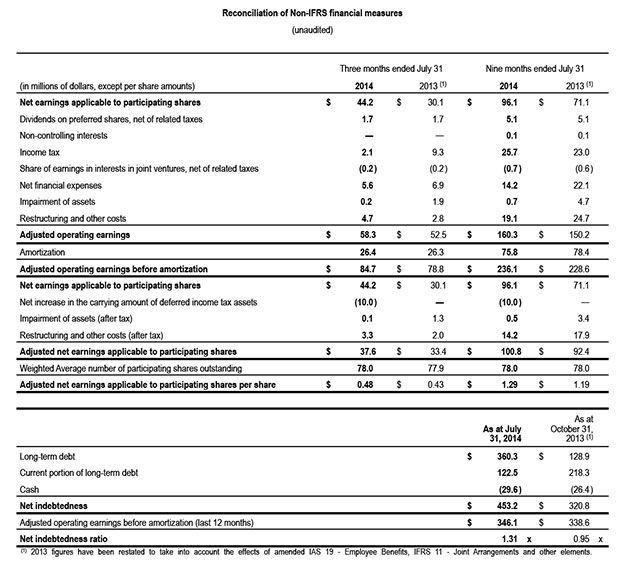

- Maintained a solid financial position, with a net indebtedness ratio of 1.31x.

Montreal, September 11, 2014 - Transcontinental Inc.'s (TSX: TCL.A, TCL.B, TCL.PR.D) revenues increased 1.9% in the third quarter, from $490.7 million to $500.0 million, primarily due to the contribution from acquisitions, namely Capri Packaging and Sun Media Corporation's weekly newspapers in Quebec, as well as new agreements in our two operating sectors. This increase was partially offset by the soft advertising market, which continues to influence both operating sectors.

Adjusted operating earnings rose 11.0%, from $52.5 million to $58.3 million. This performance is due to the contribution from acquisitions, new printing and distribution agreements, the company-wide optimization of our cost structure and our highly efficient printing platform. It was partially offset by the soft advertising market as mentioned above. Net earnings applicable to participating shares rose from $30.1 million, or $0.39 per share, to $44.2 million, or $0.56 per share. This improvement stems mainly from lower income taxes following a favourable unusual impact and an improvement in our operating earnings. Adjusted net earnings applicable to participating shares grew 12.6%, from $33.4 million, or $0.43 per share, to $37.6 million, or $0.48 per share.

"I'm satisfied with our third quarter results, notably the 1.9% increase in consolidated revenues and the 12.6% increase in our profitability. During the quarter we completed two acquisitions that add value to our business, strengthen our assets and diversify our operations. On the one hand, the integration of Capri Packaging is producing the expected results in a new area of operations, namely flexible plastic packaging. On the other hand, following the acquisition of the Sun Media Corporation weekly newspapers in Quebec and the beginning of their integration into our network, we expect the synergies from this transaction will be realized as planned.

"The printing operations continued to perform well and should pursue this path in the fourth quarter. The Media Sector, for its part, is staying on course to improve its profitability by integrating its recent acquisition and aligning its cost structure with the new reality of the market," said François Olivier, President and Chief Executive Officer of TC Transcontinental.

Supplementary Information

- On May 3, 2014, the Corporation completed the acquisition of the assets of Capri Packaging, a supplier of flexible packaging solutions, operating two facilities located in Clinton, Missouri. The acquisition will add about US$72 million to TC Transcontinental's revenues. As part of the transaction, the seller, Schreiber Foods, Inc. has signed a 10-year agreement to secure Capri Packaging as a strategic supplier of flexible packaging solutions, which represents about 75% of Capri's total revenues.

- On May 5, 2014, TC Transcontinental Printing signed a multi-year agreement with Postmedia Network Inc. to print The Gazette, distributed primarily in the Montreal market. This agreement builds on our recent announcement to print the Vancouver Sun and the Calgary Herald.

- On May 8, 2014, the Corporation completed a private financing agreement for an amount of $250 million of 3.897% senior unsecured notes due in 2019. Transcontinental Inc. used the net proceeds to repay outstanding indebtedness under its revolving credit facility and for general corporate purposes.

- On June 6, 2014, TC Transcontinental was again ranked by Corporate Knights, the independent Canadian-based media company, as one of Canada's Best 50 Corporate Citizens. This recognition is a testament to the relevance of the Corporation's initiatives as part of its ongoing commitment to sustainability.

- On September 3, 2014, Transcontinental Inc. announced the completion of the sale process involving 33 weekly newspapers as required by the Competition Bureau with respect to the Corporation's acquisition of Sun Media Corporation's 74 weekly newspapers in Quebec and their related Web properties. Of those 33 newspapers, 14 found buyers. Of that number, three will continue to be published as weekly papers and 11 will now be published online only. Furthermore, following the completion of this process, Transcontinental Inc. is reorganizing its weekly newspaper portfolio and will no longer publish 20 of its titles. The TC Media consolidated portfolio of newspapers in Quebec now consists of close to 120 titles.

- On September 11, 2014, Transcontinental Inc. announced that it will exercise its right to redeem all of its 4 million outstanding Cumulative 5-Year Rate Reset First Preferred Shares, Series D on October 15, 2014 at the price per share of $25.00, for an aggregate total of $100 million. The Corporation intends to use its revolving credit facility to finance the share redemption.

Highlights of the First Nine Months

For the first nine months of 2014, TC Transcontinental's revenues decreased 2.4%, from $1,534.1 million to $1,497.5 million, primarily as a result of the soft advertising market in our two operating sectors, particularly in the printing of marketing products. The decrease was partially offset by the contribution from acquisitions and new printing and distribution agreements. Adjusted operating earnings grew 6.7 %, from $150.2 million to $160.3 million, attributable to the contribution from acquisitions, the positive effect of the Canadian dollar vis-à-vis the U.S. dollar, and our cost-structure optimization. This increase was partially offset by softness in the advertising market. Net earnings applicable to participating shares rose from $71.1 million, or $0.91 per share, to $96.1 million, or $1.23 per share. The improvement stems mainly from the increase in our operating earnings and lower financial expenses. Excluding unusual items, adjusted net earnings applicable to participating shares rose 9.1%, from $92.4 million, or $1.19 per share, to $100.8 million, or $1.29 per share.

For more detailed financial information, please see Management's Discussion and Analysis for the third quarter ended July 31st, 2014 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook

New agreements to print magazines, newspapers and marketing products signed since the start of the fiscal year will reduce the impact of difficult market conditions which will continue to influence these niches. We believe that our printing offering to major retail chains will remain relatively stable and we are continuing to improve our point-of-purchase product marketing services. We will continue to optimize our cost structure and operations in order to maintain our long-term profitability.

The integration of Capri Packaging and the development of our new growth vector in the flexible packaging industry are moving forward through our plan to build the loyalty of existing customers and attract new ones. Results to date are encouraging and we will be looking at optimizing our operations to increase productivity.

The Media Sector should continue to benefit from cost-saving initiatives and new flyer distribution agreements that will reduce the impact of a difficult advertising market. Furthermore, we anticipate an annualized impact of about $20 million on our operating earnings before amortization from the acquisition of the Sun Media Corporation weekly newspapers in Quebec. However, these synergies may take slightly longer to realize given the delays caused by the Competition Bureau's requirement that some newspapers be put up for sale. We also expect to incur about $5 million in restructuring and other costs related to the reorganization of our weekly newspaper portfolio.

Additional long-term financing has been arranged to provide the financial flexibility needed to ensure our transformation and execute our growth strategy. We have maintained an excellent financial position and a balanced approach to capital management so that we can reduce our debt, pay dividends and invest in our transformation focused on our core competencies. We are also continuing to develop internal projects and evaluate our assets in order to maintain our leading position in our niches; at the same time we are developing our new packaging growth vector to ensure the long-term success and profitability of the business.

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividends

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.16 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on October 24, 2014 to shareholders of record at the close of business on October 6, 2014.

Dividend on Preferred shares

The Corporation's Board of Directors declared a quarterly dividend of $0.4253 per share on Cumulative 5-Year Rate Reset First Preferred Shares, Series D. This dividend is payable on October 15, 2014. On an annual basis, this represents a dividend of $1.6875 per preferred share.

Additional Information

Conference Call

Upon releasing its third quarter 2014 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-in only mode or tune in to the simultaneous audio broadcast on the Corporation's website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514-954-3581.

Profile

Largest printer and a leading provider of media and marketing activation solutions in Canada, TC Transcontinental creates products and services that allow businesses to attract, reach and retain their target customers. The Corporation specializes in print and digital media, the production of magazines, newspapers, books and custom content, mass and personalized marketing, interactive and mobile applications, door-to-door distribution, and also supplies a range of flexible packaging solutions in the United States.

Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D), including TC Transcontinental, TC Media, TC Transcontinental Printing and TC Transcontinental Packaging, has over 9,000 employees in Canada and the United States, and revenues of C$2.1 billion in 2013. Website www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world and particularly in Canada and the United States, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities, the regulatory environment, the safety of our packaging products used in the food industry, innovation of our offering and concentration of our sales in certain segments. The main risks, uncertainties and factors that could influence actual results are described in Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2013, in the latest Annual Information Form and have been updated in the MD&A for the third quarter ended July 31st, 2014.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of nonrecurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of September 11, 2014.

The forward-looking statements in this press release are made pursuant to the "safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at September 11, 2014. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

- 30 -

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate

Communications

TC Transcontinental

Telephone : 514-954-3581

nathalie.st-jean@tc.tc

Financial Community

Jennifer F. McCaughey

Senior Director, Investor Relations

and External Corporate Communications

TC Transcontinental

Telephone : 514-954-2821

jennifer.mccaughey@tc.tc