Transcontinental Inc. announces transformational acquisition of Coveris Americas, becoming a North American leader in flexible packaging

Montréal, April 2, 2018 – Transcontinental Inc. (TSX: TCL.A, TCL.B) ("TC Transcontinental" or the "Corporation") is pleased to announce that it has entered into a definitive agreement to acquire the business of Coveris Americas (the "Acquisition"), a business held by Coveris Holdings S.A., a portfolio company of Sun Capital Partners, Inc. The purchase price is US$1.32 billion (approximately C$1.72 billion1), subject to customary closing adjustments (the "Purchase Price").

Coveris Americas is one of the top ten converters of flexible packaging and other value-added products in North America based on revenues for its fiscal year ended December 31, 2017. Headquartered in Chicago, Illinois, Coveris Americas manufactures a variety of flexible plastic and paper products, including rollstock, bags and pouches, coextruded films, shrink films, coated substrates and labels. As of December 31, 2017, Coveris Americas operated 21 production facilities worldwide, namely in the Americas, the United Kingdom and Australasia. Coveris Americas has over 3,100 employees, the majority of whom are located in the Americas. For its fiscal year ended December 31, 2017, Coveris Americas generated US$966 million in revenues and US$128 million in Adjusted EBITDA.

"Today’s announcement marks a turning point in TC Transcontinental’s 42-year history. This transaction crystallizes our strategic shift toward flexible packaging and solidifies our commitment to profitable growth," said Isabelle Marcoux, Chair of the Board of Transcontinental Inc. "We are convinced that this transformational acquisition will be a driver in the creation of long-term value for all of our stakeholders. It is with pride that we begin the next chapter of our successful journey with Coveris Americas, its employees and customers, building on our values of respect, teamwork, performance and innovation."

"We are thrilled to announce such a game-changing transaction for TC Transcontinental and to bring our vision of becoming a North American leader in flexible packaging to life," said François Olivier, President and Chief Executive Officer of TC Transcontinental. "The acquisition of Coveris Americas adds significant depth and scale to our existing platform, with flexible packaging operations now expected to be our largest division in terms of TC Transcontinental's pro forma revenues based on its fiscal year 2017. This transaction complements and bolsters our existing product offering in several flexible packaging end markets including dairy, pet food and consumer products. Additionally, it allows us to enter new and attractive flexible packaging end markets such as agriculture, beverage and protein. We are looking forward to building on our combined strengths and to continue working with Coveris Americas’ loyal customers, many of whom are market leaders. We are also eager to welcome Coveris Americas’ talented employees who will bring their leading-edge expertise to TC Transcontinental."

Craig Reese, Chief Executive Officer of Coveris Americas, said: "Today marks an exciting milestone for Coveris Americas as we join TC Transcontinental, a company that shares our passion for growth through innovation, service and quality."

Marc Leder, Co-Chief Executive Officer of Sun Capital Partners, Inc., whose affiliate owns Coveris Holdings S.A., added: "We are extremely proud of our partnership with the management team to grow and improve Coveris Americas, and we are confident that TC Transcontinental is the right home for the business to continue its industry leadership."

Complementing its solid printing and media operations, this Acquisition significantly diversifies TC Transcontinental’s business into flexible packaging. Based on Coveris Americas’ financial results for its fiscal year ended December 31, 2017 and on TC Transcontinental's financial results for its fiscal year ended October 29, 2017, the pro forma consolidated revenues and Adjusted EBITDA for the combined entity for fiscal 2017 are estimated at C$3.3 billion and C$564 million, respectively, with flexible packaging accounting for approximately 48% of total revenues.

The terms of the Acquisition have been approved by the boards of directors of both TC Transcontinental and Coveris Americas. The Acquisition, which remains subject to certain customary closing conditions and receipt of applicable antitrust approvals, is expected to be completed in the third quarter of TC Transcontinental's fiscal year 2018.

[1] Converted at CAD/USD exchange rate of 1.30:1.00.

ACQUISITION RATIONALE

- The Acquisition positions TC Transcontinental among the top ten flexible packaging converters in North America

- Creates a leading flexible packaging supplier in North America with pro forma combined revenues attributable to the packaging division of C$1.6 billion and Adjusted EBITDA of C$210 million in fiscal 2017.2

- The Acquisition provides TC Transcontinental with a strong position across a broad range of flexible packaging's growing end markets

- Strong pro forma position in dairy, pet food, beverage, agriculture and consumer products.

- The Acquisition expands TC Transcontinental's product offering with best-in-class capabilities and greater film manufacturing capabilities

- Complementary manufacturing capabilities in printing, lamination, converting and extrusion, with significant expertise in high-end blown extrusion as well as cast extrusion;

- Expansion of product offering with barrier films, thermoformed films, shrink bags, cast nylon, multi-wall bags, banana tree bags, mulch films and coatings, among others; and

- Capability to insource a portion of film production.

- The Acquisition enhances TC Transcontinental's relationships with large, market leading customers

- Coveris Americas brings a broad portfolio of approximately 3,500 customers, including longstanding relationships with many key accounts.

- The Acquisition provides an integrated flexible packaging platform leading to potential economies of scale

- Adds an extensive footprint of 21 well-invested production facilities in the United States, Canada, Ecuador, Guatemala, Mexico, the United Kingdom, New Zealand and China to TC Transcontinental's 7 existing flexible packaging facilities; and

- Increases business scale thereby strengthening TC Transcontinental’s competitive position.

[2] Based on Coveris Americas’ financial results for its fiscal year ended December 31, 2017 and on TC Transcontinental's financial results for its fiscal year ended October 29, 2017.

HIGHLIGHTS OF FINANCIAL BENEFITS OF THE ACQUISITION

-

Immediately accretive to adjusted net earnings per share3 and free cash flow per share before cost synergies

-

Expected annual cost synergies of approximately US$20 million to be achieved over a 24-month period following the Acquisition, generated mainly from economies of scale.

[3] Exclude amortization of transaction-related intangibles.

FINANCING OF THE ACQUISITION

Financing Highlights

- The Acquisition will be financed through a combination of:

- Cash on hand; and

- Fully-committed financing from CIBC and Scotiabank providing term loans.

- TC Transcontinental's pro forma Net Debt to Adjusted EBITDA is expected to be 3.2x at the closing date of the Acquisition and to decline close to 2.0x by the end of fiscal year 2020.

ADVISORS

BMO Capital Markets and J.P. Morgan Securities LLC acted as financial advisors to TC Transcontinental on the Acquisition.

Legal advice is being provided to TC Transcontinental with respect to U.S. law, by Morgan, Lewis & Bockius LLP, and, with respect to Canadian law, by Stikeman Elliott LLP.

CONFERENCE CALL INFORMATION

TC Transcontinental will hold a conference call for the financial community today at 8:30 a.m. (Eastern Daylight Time). The dial-in numbers are 1 647 788-4922 or 1 877 223-4471 and the conference ID is 6865698. Media may hear the call in listen-in only mode or tune in to the simultaneous audio broadcast on the Corporation's website, which will then be archived for 30 days. For the conference recording playback, dial in numbers are 1 416 621-4642 or 1 800 585-8367.

AVAILABILITY OF DOCUMENTS

A copy of the securities purchase agreement relating to the Acquisition will be available on SEDAR (www.sedar.com) as part of the public filings of TC Transcontinental and on TC Transcontinental's website at www.tc.tc.

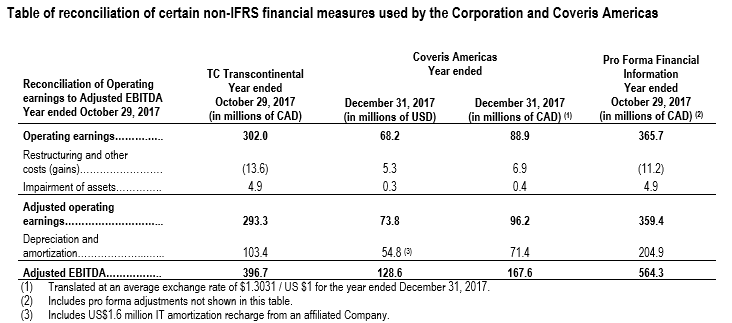

NON-IFRS MEASURES

This press release refers to financial measures that are not recognized under International Financial Reporting Standards (IFRS). A non-IFRS financial measure is a numerical indicator of a company's performance, financial position or cash flow that excludes or includes amounts, or is subject to adjustments that have the effect of excluding or including amounts that are included or excluded in most directly comparable measures calculated and presented in accordance with IFRS. Non-IFRS measures do not have any standardized meaning under IFRS and therefore are unlikely to be comparable to similar measures presented by other companies having the same or similar businesses.

The Corporation believes these measures are useful supplemental information. The following non-IFRS measures are used by the Corporation in this press release: EBITDA, Adjusted EBITDA, pro forma Adjusted EBITDA, adjusted net earnings per share, free cash flow per share and pro forma Net Debt to Adjusted EBITDA. The Corporation also presents in this press release the Adjusted EBITDA of Coveris Americas.

Please find below definitions of non-IFRS financial measures used by the Corporation and Coveris Americas herein:

"EBITDA" means the operating earnings before depreciation and amortization; when used in respect of TC Transcontinental, for the fiscal year ended October 29, 2017, and when used in respect of Coveris Americas, for the fiscal year ended December 31, 2017.

"Adjusted EBITDA" means the operating earnings before depreciation and amortization as well as restructuring and other costs (gains) and impairment of assets; when used in respect of TC Transcontinental, for the fiscal year ended October 29, 2017, and when used in respect of Coveris Americas, for the fiscal year ended December 31, 2017.

"pro forma Adjusted EBITDA" means the sum of the Adjusted EBITDA including pro forma adjustments of Coveris Americas for the fiscal year ended December 31, 2017, and the Adjusted EBITDA of TC Transcontinental for the fiscal year ended October 29, 2017.

"adjusted net earnings per share" means the net earnings of TC Transcontinental before restructuring and other costs (gains) and impairment of assets, net of related income taxes, for the fiscal year ended October 29, 2017, divided by the weighted average number of issued and outstanding shares of TC Transcontinental as at the end of the fiscal year ended October 29, 2017.

"free cash flow per share" means the adjusted operating earnings of TC Transcontinental before depreciation and amortization less the sum of capital expenditures, interest paid and income taxes paid for the fiscal year ended October 29, 2017, divided by the weighted average number of issued and outstanding shares of TC Transcontinental as at the end of the fiscal year ended October 29, 2017.

"pro forma Net Debt to Adjusted EBITDA" means TC Transcontinental's projected indebtedness as of closing of the Acquisition divided by the pro forma Adjusted EBITDA.

Please find below the reconciliation of certain non-IFRS financial measures used by the Corporation and Coveris Americas herein:

FORWARD-LOOKING STATEMENTS

This press release contains statements that are "forward-looking statements" or "forward-looking information" within the meaning of applicable Canadian securities legislation, including those regarding the Acquisition. Forward-looking statements also include, but are not limited to, statements regarding TC Transcontinental's business objectives, expected growth, results of operations, performance and financial results, statements with respect to the expected timing and completion of the Acquisition, and statements with respect to the anticipated benefits of the Acquisition and TC Transcontinental's ability to successfully integrate Coveris Americas’ business, which include, without limitation, cost synergies, future revenues, economic performance, economies of scale, accretive to adjusted net earnings per share, accretive to free cash flow per share, leverage post-Acquisition, management strategy and growth prospect following the Acquisition. The pro forma information set forth in this press release should not be considered as a prediction of what the actual financial position or other results of operation of the Corporation would have necessarily been had the Acquisition been completed as, at, or for the periods stated. This press release also contains forward-looking statements with respect to the indebtedness to be incurred under the existing credit facilities and new committed credit facilities and the aggregate Purchase Price payable in connection with the Acquisition of Coveris Americas. Forward-looking statements typically use the conditional, as well as words such as prospect, believe, estimate, forecast, synergies, project, expect, anticipate, plan, may, should, could and would, or the negative of these terms, variations thereof or similar terminology as they relate to TC Transcontinental, Coveris Americas or the combined entity following the Acquisition. Forward-looking statements also include any other statements that do not refer to historical facts.

These forward-looking statements are used to assist readers in obtaining a better understanding of TC Transcontinental's business, current objectives, strategic priorities, expectations and plans, including following the Acquisition, and may not be appropriate for other purposes. By their very nature, forward-looking statements are based on assumptions and involve inherent risks and uncertainties, both general and specific in nature. It is therefore possible that the forecasts, projections and other forward-looking statements will not be achieved or will prove to be inaccurate. Although TC Transcontinental believes that the expectations, opinions, projections and comments reflected in these forward-looking statements are reasonable and appropriate, it can give no assurance that such statements will prove to be correct. The assumptions generally used by TC Transcontinental in making forward-looking statements are included in TC Transcontinental's Management's Discussion and Analysis (the "Annual MD&A") for the financial year ended October 29, 2017 available under the Corporation's profile on SEDAR at www.sedar.com. In relation to the Acquisition, TC Transcontinental makes the following material assumptions, without limitation: availability of capital resources, performance of operating facilities, strength of market conditions, customer demand and satisfaction of customary closing conditions, including antitrust approvals. If these assumptions are inaccurate, TC Transcontinental's or the combined entity's actual results could differ materially from those expressed or implied in such forward-looking statements.

TC Transcontinental cautions readers against placing undue reliance on forward-looking statements when making decisions, as the actual results could differ considerably from the opinions, plans, projections, objectives, expectations, forecasts, estimates and intentions expressed in such forward-looking statements due to various risk factors. These risk factors include, but are not limited to: the possible failure to realize anticipated benefits of the Acquisition or to achieve the full amount of anticipated cost synergies, failure to close the Acquisition, changes in the terms of the Acquisition, increased indebtedness, transitional risks, Acquisition integration related risks, loss of certain key personnel of Coveris Americas, potential undisclosed costs or liabilities associated with the Acquisition, the information provided by Coveris Americas not being accurate or complete, changes in interest rates, inflation levels and general economic conditions, legislative and regulatory developments and changes in competition.

TC Transcontinental further cautions that the foregoing list of factors is not exhaustive. For more information on the risks, uncertainties and assumptions that would cause TC Transcontinental's actual results to differ from current expectations, please also refer to the main risks, uncertainties and factors described in the Annual MD&A and in the Revised Annual Information Form of TC Transcontinental for the fiscal year ended October 29, 2017, which have been updated in the Management's Discussion and Analysis for TC Transcontinental's first quarter ended January 28, 2018, as well as to other public filings available under TC Transcontinental's profile on SEDAR at www.sedar.com.

The forward-looking statements contained in this press release are expressly qualified in their entirety by the foregoing cautionary statements. The forward-looking statements contained herein reflect TC Transcontinental's expectations and beliefs as at the date hereof, and are subject to change after this date. TC Transcontinental does not undertake to update any forward-looking statements, whether oral or written, made by it or on its behalf, except to the extent required by applicable Canadian securities legislation or regulation. All subsequent forward-looking statements made by TC Transcontinental or any of its directors, officers or employees or any persons authorized to be acting on their behalf, whether written or oral, are expressly qualified in their entirety by the foregoing cautionary statements.

Financial outlook information contained in this press release about prospective results of operations, financial position or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, and based on management's assessment of the relevant information available as of the date of this press release. Readers are cautioned that such financial outlook information contained in this press release should not be used for the purposes other than for which it is disclosed herein or therein, as the case may be.

ABOUT TC TRANSCONTINENTAL

TC Transcontinental is Canada's largest printer and a key supplier of flexible packaging in North America. The Corporation is also a leader in its specialty media segments. TC Transcontinental's mission is to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are strong values held by TC Transcontinental and its employees. TC Transcontinental's commitment to its stakeholders is to pursue its business activities in a responsible manner.

TC Transcontinental currently has over 6,100 employees in Canada and the United States, and had revenues of approximately $2.0 billion for the fiscal year ended October 29, 2017. For more information, visit TC Transcontinental's website at www.tc.tc.

– 30 –

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone: 514-954-3581

nathalie.st-jean@tc.tc

www.tc.tc

Financial Community

Shirley Chenny

Advisor, Investor Relations

TC Transcontinental

Telephone: 514-954-4166

shirley.chenny@tc.tc

www.tc.tc