Transcontinental Inc. announces its financial results for the third quarter of Fiscal 2017

Highlights

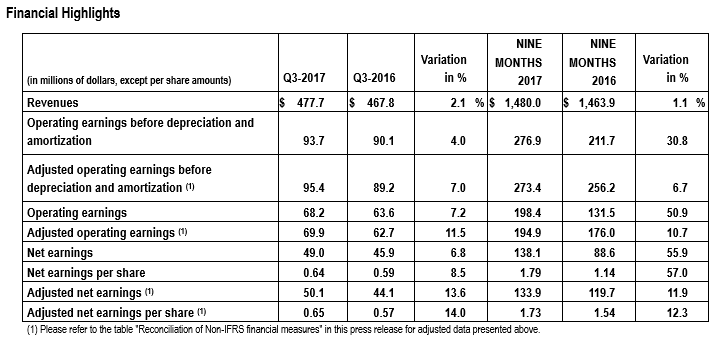

- Revenues increased by $9.9 million, or 2.1%.

- Operating earnings increased by $4.6 million, from $63.6 million to $68.2 million. Adjusted operating earnings, which exclude restructuring and other costs (revenues) and impairment of assets, increased by $7.2 million, or 11.5%.

- Net earnings increased by $3.1 million, from $45.9 million to $49.0 million. Adjusted net earnings, which exclude restructuring and other costs (revenues) and impairment of assets, net of related taxes, increased by $6.0 million, or 13.6%.

Montreal, September 7, 2017 - Transcontinental Inc. (TSX: TCL.A TCL.B) announces its results for the third quarter of Fiscal 2017, which ended July 30, 2017.

"I am proud of what we achieved in the third quarter as we continued to deploy our transformation plan while improving the Corporation's performance," said François Olivier, President and Chief Executive Officer of TC Transcontinental. "Our financial performance is the result of our promising strategy, diligently implemented by our teams throughout the organization."

"The printing division posted a solid quarter, thanks to the increased demand by Canadian retailers for our service offering, in particular printed flyers. The packaging division generated, for its part, sustained organic growth resulting from the investments we made in the last few quarters. Lastly, in the Media Sector, the Business and Education group performed very well, and the process to sell our local newspapers in Quebec and Ontario is thriving. Discussions are continuing with potential acquirers in several regions."

"Our enviable financial position and our significant cash flows provide the solid foundations that will allow us to maintain our momentum and invest in our development."

2017 Third Quarter Results

Revenues went from $467.8 million in the third quarter of 2016 to $477.7 million in the third quarter of 2017, an increase of 2.1%. This increase is attributable to the contribution from the acquisitions in the packaging division, as well as the favourable exchange rate effect and the organic growth in revenues for the Printing and Packaging Sector. Organic growth in revenues is attributable to higher volume in the packaging division and higher demand for all services to Canadian retailers, namely for flyer and in-store marketing printing services, as well as for premedia and door-to-door distribution services, notably under the terms of the expanded agreement with Lowe's Canada, partially offset by the decline in revenues from the other printing division verticals. The above-mentioned revenue increase is also attributable to the contribution from the acquisition of specialty financial brands and to the organic growth in revenues for the Media Sector, in particular from the educational book publishing activities. However, the contribution from these items was more than offset, mostly by the impact of the sale of media assets and the decline in revenues from the local newspaper publishing activities caused by lower advertising revenues.

Operating earnings increased by $4.6 million, from $63.6 million in the third quarter of 2016 to $68.2 million in the third quarter of 2017. Adjusted operating earnings went from $62.7 million in the third quarter of 2016 to $69.9 million in the third quarter of 2017, an increase of 11.5%. Excluding the unfavourable effect of the stock-based compensation expense as a result of the change in the share price in the third quarter of 2017 compared to the corresponding period in 2016, adjusted operating earnings increased by 18.0%. This increase is mostly attributable to the performance of the Printing and Packaging Sector due to the above-mentioned organic growth in revenues, the favourable impact of cost reduction initiatives in the printing division, the contribution from the acquisitions in the packaging division and the favourable exchange rate effect for the sector. The above-mentioned adjusted operating earnings increase is also notably attributable to the organic growth in revenues from the educational book publishing activities and the contribution from cost reduction initiatives in the Media Sector. The contribution of these items was however partially offset by the impact of the sale of media assets.

Net earnings increased by $3.1 million, from $45.9 million in the third quarter of 2016 to $49.0 million in the third quarter of 2017. This increase is mostly attributable to the increase in operating earnings, partially offset by the increase in net financial expenses. On a per share basis, net earnings went from $0.59 to $0.64. Excluding restructuring and other costs (revenues) and impairment of assets, net of related income taxes, adjusted net earnings increased by $6.0 million, or 13.6%, from $44.1 million in the third quarter of 2016 to $50.1 million in the third quarter of 2017. On a per share basis, adjusted net earnings went from $0.57 to $0.65.

2017 First Nine Months Results

Revenues went from $1,463.9 million in the first nine months of 2016 to $1,480.0 million in the first nine months of 2017, an increase of 1.1%. This increase is mostly attributable to the contribution from the acquisitions in the packaging division and the favourable exchange rate effect for the Printing and Packaging Sector. Moreover, the organic growth in revenues generated by higher volume in the packaging division and higher demand for all services to Canadian retailers, as well as the additional volume from the agreement to print the Toronto Star also contributed to the increase in revenues. However, the contribution from these items, related to organic growth, only partially offset the lower volume in several verticals affected by the decline in advertising spending and the impact of the completion of the agreement to print Canada's Census forms in 2016. The above-mentioned revenue increase is also attributable to the contribution from the acquisition of specialty financial brands and the organic growth in revenues for the Media Sector, in particular from the educational book publishing activities. However, the contribution from these items was more than offset, mostly by the impact of the sale of media assets and the decline in revenues from the local newspaper publishing activities caused by lower advertising revenues.

Operating earnings increased by $66.9 million, from $131.5 million in the first nine months of 2016 to $198.4 million in the corresponding period in 2017. Adjusted operating earnings went from $176.0 million in the first nine months of 2016 to $194.9 million in the corresponding period in 2017, an increase of 10.7%. Excluding the $13.1 million unfavourable effect of the stock-based compensation expense as a result of the change in the share price in the first nine months of 2017 compared to the corresponding period in 2016, adjusted operating earnings increased by 18.2%. This increase is mostly attributable to the performance of the Printing and Packaging Sector as a result of the above-mentioned organic growth in revenues and the favourable impact of cost reduction initiatives in the printing division, partially offset by the impact of the investments made in the last few quarters to develop the packaging division's platform and strengthen its sales force. The contribution from the acquisitions in the packaging division and the favourable exchange rate effect for the sector also contributed to the increase. The above-mentioned adjusted operating earnings increase is also attributable to the contribution from cost reduction initiatives in the Media Sector, the organic growth in revenues from the educational book publishing activities and the contribution from the acquisition of specialty financial brands. These items were however partially offset by the impact of the sale of local newspapers.

Net earnings increased by $49.5 million, from $88.6 million in the first nine months of 2016 to $138.1 million in the corresponding period in 2017. This increase in mostly attributable to the increase in operating earnings, partially offset by the increase in income taxes. On a per share basis, net earnings went from $1.14 to $1.79. Excluding restructuring and other costs (revenues) and impairment of assets, net of related income taxes, adjusted net earnings increased by $14.2 million, or 11.9%, from $119.7 million in the first nine months of 2016 to $133.9 million in the corresponding period in 2017. On a per share basis, adjusted net earnings went from $1.54 to $1.73.

For more detailed financial information, please see the Management's Discussion and Analysis for the third quarter ended July 30, 2017 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook for 2017

In the printing division, we expect revenues from all our retailer-related services to remain relatively stable in the fourth quarter of 2017 compared to the same period in 2016. In all the other printing verticals, we expect that our revenues will continue to be affected by a decline in volume and the end of the additional contribution from the agreement to print the Toronto Star, which had started in July 2016. In addition, we will no longer benefit from the additional contribution of plant closures which occurred in 2016, although we will continue our operational efficiency initiatives to partially offset the decline in volume.

In our packaging division, in the fourth quarter of 2017, we will continue to benefit from the contribution from the acquisition of Flexstar Packaging, which was completed in mid-October 2016. In addition, we expect that the efforts of our sales force will continue to bear fruit and generate sustained organic growth, and we will maintain our disciplined acquisition approach.

In the Media Sector, the Business and Education group will benefit from the contribution from our acquisition of specialty financial brands completed in December 2016, and we expect that this group will continue to perform well. The sale of our media assets in Atlantic Canada and the continuation of the process to sell our local newspapers in Quebec and Ontario will greatly reduce the share of our local newspaper publishing activities in our media portfolio in the fourth quarter of 2017.

To conclude, in the fourth quarter of this fiscal year, we expect to generate significant cash flows and maintain our excellent financial position, which should enable us to continue investing to support our transformation into flexible packaging.

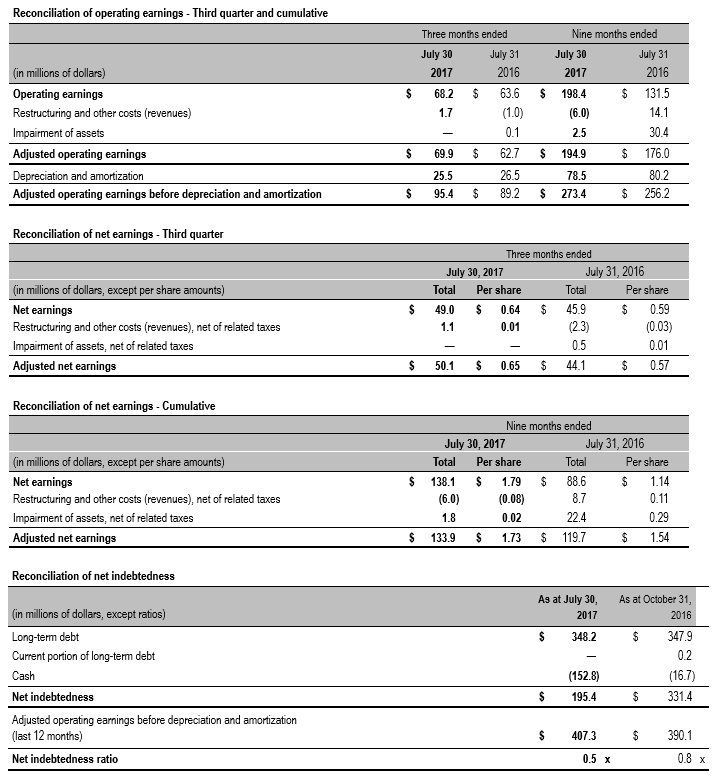

Reconciliation of Non-IFRS Financial Measures

The financial information has been prepared in accordance with IFRS. However, financial measures used, namely the adjusted operating earnings, the adjusted operating earnings before depreciation and amortization, the adjusted net earnings, the adjusted net earnings per share, the net indebtedness and the net indebtedness ratio, for which a complete definition is presented in the Management's Discussion and Analysis for the third quarter ended July 30, 2017, and for which a reconciliation is presented in the following table, do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many of our readers analyze the financial performance of the Corporation's activities based on these non-IFRS financial measures as such measures may allow for easier comparisons between periods. These measures should be considered as a complement to financial performance measures in accordance with IFRS. They do not substitute and are not superior to them.

We also believe that the adjusted operating earnings before depreciation and amortization, the adjusted operating earnings, that takes into account the impact of past investments in property, plant and equipment and intangible assets, and the adjusted net earnings are useful indicators of the performance of our operations. Furthermore, management also uses some of these non-IFRS financial measures to assess the performance of its activities and managers.

Regarding the net indebtedness and net indebtedness ratio, we believe that these indicators are useful to measure the Corporation's financial leverage and ability to meet its financial obligations.

Dividend

The Corporation's Board of Directors declared a quarterly dividend of $0.20 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on October 18, 2017 to shareholders of record at the close of business on October 2, 2017.

Conference Call

Upon releasing its third quarter of 2017 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-in only mode or tune in to the simultaneous audio broadcast on the Corporation's website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Communications of TC Transcontinental, at 514 954-3581.

Profile

Canada's largest printer with operations in print, flexible packaging, publishing and digital media, TC Transcontinental's mission is to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are strong values held by the Corporation and its employees. The Corporation's commitment to its stakeholders is to pursue its business and philanthropic activities in a responsible manner.

Transcontinental Inc. (TSX: TCL.A TCL.B), known as TC Transcontinental, has more than 7,000 employees in Canada and the United States, and revenues of C$2.0 billion in 2016. Website www.tc.tc

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world and particularly in Canada and the United States, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities, the regulatory environment, the safety of its packaging products used in the food industry, innovation of its offering and concentration of its sales in certain segments. The main risks, uncertainties and factors that could influence actual results are described in Management's Discussion and Analysis (MD&A) for the fiscal year ended October 31, 2016, in the latest Annual Information Form and have been updated in the MD&A for the third quarter ended July 30, 2017.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of nonrecurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of September 7, 2017.

The forward-looking statements in this press release are made pursuant to the "safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at September 7, 2017. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

- 30 -

For information:

|

Media |

Financial Community |