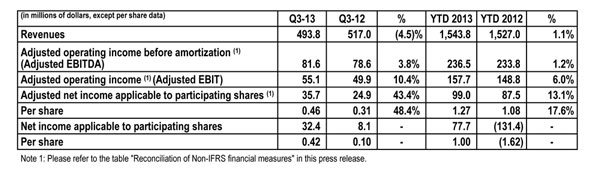

Transcontinental Inc adjusted operating income increases for fourth consecutive quarter

Highlights

- Increase of 10.4% in adjusted operating income.

- Significant growth of 43.4% in adjusted net income applicable to participating shares, from $24.9 million to $35.7 million; on a per-share basis, it rose from $0.31 to $0.46.

- Revenues down 4.5%, mainly due to the end of the contract to print and distribute Zellers flyers, a change in the format and type of paper used by some of our major customers, and difficult market conditions which affected our magazine, book and catalogue printing business as well as our publications.

- TC Transcontinental Printing signed a five-year agreement to print the Calgary Herald, owned by Postmedia Network Inc.

- More than $35 million to date in synergies from the acquisition of Quad/Graphics Canada, Inc.

- Maintained a solid financial position with a net indebtedness ratio of 1.02x.

Montreal, September 12, 2013 -Transcontinental Inc.'s (TSX: TCL.A, TCL.B, TCL.PR.D) third-quarter revenues decreased from $517.0 million in 2012 to $493.8 million in 2013, mainly due to the end of the contract to print and distribute Zellers flyers after its store closures. Other factors were the change in the format and type of paper used by some of our major customers, difficult market conditions affecting our magazine, book and catalogue printing business, and a soft advertising market which continued to impact our Media Sector, particularly with respect to local markets. The decrease was partially offset by new printing contracts, higher volume in educational book publishing and the acquisitions of Modulo and Redux Media, among others.

Third quarter adjusted operating income rose 10.4%, from $49.9 million to $55.1 million. This growth stems mainly from additional synergies from the integration of Quad/Graphics Canada, Inc. and higher volume in our educational book publishing business. It was partially offset by the above-noted soft advertising market and lower volume in our custom content creation business. Net income applicable to participating shares rose from $8.1 million, or $0.10 per share, to $32.4 million, or $0.42 per share. Excluding unusual items, adjusted net income applicable to participating shares rose 43.4%, from $24.9 million to $35.7 million. On a per-share basis, it rose from $0.31 to $0.46.

"Our third quarter results clearly outperformed in our industry," said François Olivier, President and Chief Executive Officer. "The growth in adjusted operating income is due mainly to the excellent work by our Printing Sector in achieving synergies from the acquisition of Quad/Graphics Canada, Inc., and our strategy to optimize our cost structure. Efforts to leverage our relationships with our major retail customers also continued to produce results. Despite the pressure we are facing with regards to the advertising market in our Media Sector, we have continued to roll out our digital offering and have launched several new products and services. For upcoming quarters, our solid financial position in conjunction with our capacity to generate significant cash flows, gives us the flexibility we need to continue to invest in our development and transform our operations in order to better meet the continually evolving needs of our customers."

Quarter Highlights

- To date, TC Transcontinental has achieved more than $35 million in synergies from the acquisition of Quad/Graphics Canada, Inc. The Corporation is on track to reach its initial objective of $40 million in synergies by the end of fiscal 2013 and plans to generate additional synergies in fiscal 2014.

- TC Transcontinental Printing signed a five-year agreement with Postmedia Network Inc. to print the Calgary Herald, which is published Monday to Saturday and has a daily circulation of about 80,000 copies. The contract will start in November 2013 and will not require additional investments by TC Transcontinental Printing given its highly efficient and flexible hybrid printing platform.

- TC Media launched AutoGo.ca, a new website designed specifically for motorists looking for a new or used vehicle all across Canada. AutoGo.ca is the only automobile website that lets users search based on lifestyle. AutoGo.ca received more than 30,000 unique visitors in the first month after it was launched.

- TC Media announced the launch of the TC Media Incubator, a laboratory for the creation, development and incubation of new digital products in the company. The TC Media Incubator will be headed by Bruno Leclaire, appointed Chief Digital Officer of TC Media. The lab will get officially underway in November 2013.

- TC Transcontinental was again named one of the best 50 corporate citizens in Canada in the annual ranking by independent media company Corporate Knights. This recognition shows the relevance of the steps taken by the Corporation to meet its commitment to sustainability.

Highlights of the first nine months

For the first nine months of 2013, TC Transcontinental's revenues were up 1.1%, from $1,527.0 million to $1,543.8 million. The increase stems mainly from the acquisition of Quad/Graphics Canada, Inc. and acquisitions in the Media Sector. It was partially offset by the end of the contract to print and distribute Zellers flyers, by a difficult advertising environment and by the incentives granted for the early renewal of some contracts in 2012. Adjusted operating income grew 6.0%, from $148.8 million to $157.7 million, principally due to the synergies achieved from the acquisition of Quad/Graphics Canada, Inc. The increase was partially offset by the same factors as indicated above. Net income applicable to participating shares rose from a loss of $131.4 million, or $1.62 per share, to a profit of $77.7 million, or $1.00 per share. Excluding unusual items, adjusted net income applicable to participating shares rose 13.1%, from $87.5 million, or $1.08 per share, to $99.0 million, or $1.27 per share.

For more detailed financial information, please see Management's Discussion and Analysis for the third quarter ended July 31st, 2013 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook

Further synergies from the second phase of the integration of the operations of Quad/Graphics Canada, Inc. will be generated in the fourth quarter of 2013, but to a lesser degree than in past quarters. Furthermore, the Printing Sector plans to begin the final phase of the integration of these operations early in fiscal 2014, which should generate additional synergies. Since the start of fiscal 2013, we have signed new agreements to print flyers and marketing products worth about $30 million on an annualized basis whose contribution should be noted more significantly in the fourth quarter of 2013. However, such contributions will be partially offset by the closing of Zellers stores and by lower volume in our magazine, book and catalogue printing business.

The difficult market conditions with respect to advertising spending in our local and national markets are likely to continue and also affect our newspaper and magazine publishing operations. As a result, we will continue to focus on efficiency gains in order to limit potential repercussions on our profit margin. We will also continue to invest in the development of new products and services to ensure further diversification of our services.

We expect an unfavourable variance in head office costs in the fourth quarter of 2013, versus 2012, as a result of favourable non-recurring items recorded in the fourth quarter of last year. The excess cash generated in upcoming quarters, in conjunction with our excellent financial position, should permit us to keep investing in internal projects and to make strategic acquisitions if opportunities arise.

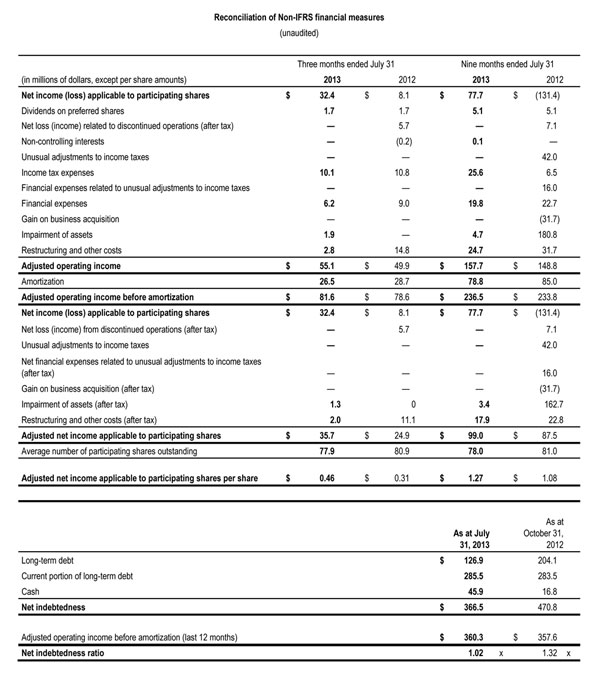

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, Management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividends

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.145 per Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on October 25, 2013 to participating shareholders of record at the close of business on October 7, 2013.

Dividend on Preferred shares

The Board declared a quarterly dividend of $0.4253 per share on cumulative 5-year rate reset first preferred shares, series D. This dividend is payable on October 15, 2013. On an annual basis, this represents a dividend of $1.6875 per preferred share.

Additional Information

Conference Call

Upon releasing its third quarter 2013 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are (514) 940-2795 or (1 416) 644-3414 or 1-800-814-4859 and the access code is: 4638287. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation's Web site, which will then be archived for 30 days. For media requests for information or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at (514) 954-3581.

Profile

Largest printer and leading provider of media and marketing activation solutions in Canada, TC Transcontinental creates products and services that allow businesses to attract, reach and retain their target customers. The Corporation specializes in print and digital media, the production of magazines, newspaper, books and custom content, mass and personalized marketing, interactive and mobile applications, TV production and door-to-door distribution.

Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D), known by the brands TC Transcontinental, TC Media and TC Transcontinental Printing, has approximately 9,500 employees in Canada and the United States, and reported revenues of C$2.1 billion in 2012. Website www.tc.tc

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world and particularly in Canada and the United States, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, as well as the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities. The main risks, uncertainties and factors that could influence actual results are described in Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2012 and in the 2012 Annual Information Form and have been updated in the MD&A for the third quarter ended July 31st, 2013.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of non-recurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of September 12, 2013.

The forward-looking statements in this press release are made pursuant to the "safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at September 12, 2013. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

- 30 -

For information:

|

Media Nathalie St-Jean |

Financial Community Jennifer F. McCaughey |