Transcontinental inc. Second quarter: revenues increase 6 percent and renews multi-year agreements valued at over $1.5 billion in revenues

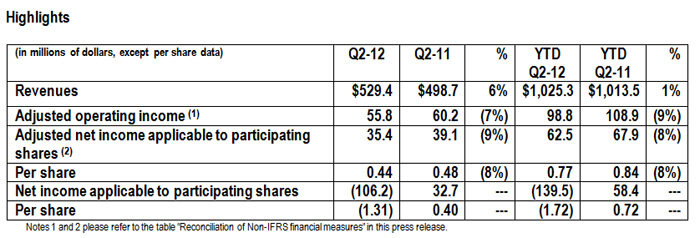

Montreal, June 7, 2012 – Transcontinental Inc. (TSX: TCL.A TCL.B TCL.PR.D) increased its revenues by 6% in the second quarter, from $498.7 million to $529.4 million, driven primarily by the acquisition of Quad/Graphics Canada, Inc. as well as numerous acquisitions and launches of community newspapers in Quebec, and new contracts such as Canadian Tire. This growth was mitigated primarily by the sale of its black and white book printing business, destined for U.S. exports, to Quad/Graphics last September and by lower volume from the non-recurring revenue from the printing contract for the Canadian Census last year. Excluding acquisitions, divestitures and closures, the impact of the exchange rate and the paper component variance, organic revenue growth was essentially flat.

- Renewed and expanded six multi-year agreements valued at over $1.5 billion in revenues with major Canadian retail customers.

- Closed the transaction for the indirect acquisition of the shares of Quad/Graphics Canada, Inc. and rapidly announced the reorganization of its print operations across Canada. The integration is on track to deliver more than $40 million in synergies as expected.

- Continued to develop its digital and interactive business by expanding its digital advertising representation deals and acquiring a majority stake in Redux Media, a leading online advertising network.

- Launched a television production house.

For this same period, adjusted operating income decreased 7%, from $60.2 million to $55.8 million, driven primarily by a new provincial legislation in Quebec under Bill 88 that imposes greater recycling fees on publishers, lower volume from the non-recurring revenue from the printing contract for the Canadian Census last year and lower volume from its educational book publishing group due to the end of the school reform in Quebec. This decrease was partially offset by synergies from the use of its most productive assets. Net income applicable to participating shares decreased from $32.7 million, or $0.40 per share, to a loss of $106.2 million, or $1.31 per share. This decrease is mainly due to an impairment of assets of $180.0 million, in the newspaper and magazine activities of the Media sector, which is non-cash and non-operational. Excluding unusual items and discontinued operations, adjusted net income applicable to participating shares decreased 9%, from $39.1 million, or $0.48 per share, to $35.4 million, or $0.44 per share.

"Our second quarter results are in line with our strategy to strengthen our existing assets and develop our new media and marketing services. We are in the process of integrating our Quad/Graphics Canada, Inc. acquisition and we are on track to generate more than $40 million in synergies and therefore become even more efficient. We also secured a large part of our cash flow for the coming years by renewing six multi-year agreements valued at over $1.5 billion in revenues with major Canadian retail customers for both existing and new services. These agreements are a testament to the strength of our customer relationships and the confidence they have in our ability to execute their integrated marketing communication programs, to the quality of our state-of-the-art national printing platform and of our flyer distribution network, the reach of our national media properties and the success of our strategy to expand our product and service offering into new marketing and communication services. In addition, we continued to develop our offering of products and services by expanding our digital advertising representation house, with the acquisition of a majority stake in Redux Media, and by launching a television production house.

Financially speaking, we continue to generate strong cash flow and have a solid financial position with a net debt to EBITDA ratio at 1.43x at the end of the quarter. For the balance of the year, we expect our results to ramp up, especially in the fourth quarter, as the previously announced synergies start to benefit our results in a more meaningful way. Therefore, we are very well positioned to continue to transform TC Transcontinental to meet our customers' evolving marketing needs," said François Olivier, President and Chief Executive Officer.

Financial Highlights of the Quarter

- As at April 30, 2012, the adjusted net indebtedness ratio was 1.43x, as compared to 1.42x as at January 31, 2012.

- Transcontinental Inc. put in place a new $400 million five-year Unsecured Revolving Credit Facility that expires in February 2017. The current credit facility will remain in place until its expiry in September 2012 but has been reduced to $200 million.

- Transcontinental Inc. put in place a normal course issuer bid. It has been authorized to purchase for cancellation on the open market, between April 13, 2012 and April 12, 2013 up to 5% of its Class A Subordinate Voting Shares and Class B Shares. The program was not used as at April 30, 2012.

For more detailed financial information, please see Management's Discussion and Analysis for the second quarter ended April 30, 2012 and the complete financial statements on our website at www.tc.tc, under "Investors."

Operating Highlights of the Quarter

- Renewed and expanded, since January 2012, six multi-year agreements valued at over $1.5 billion in revenues with major Canadian retail customers in the food, hardware, general merchandise and pharmaceutical verticals. These agreements have been extended for periods varying from three to six years and besides printing, include flyer distribution through Publisac in Quebec and often include many other products and services from the Corporation's new marketing and media services, such as digital advertising representation, e-flyers, email marketing, mobile solutions, database analytics, premedia and custom communications.

- Closed the transaction for the indirect acquisition of the shares of Quad/Graphics Canada, Inc. and rapidly announced the reorganization of its print operations across Canada. About half of the Quad/Graphics' Canada, Inc. facilities have been closed so far. The integration is on track to deliver more than $40 million in synergies as expected.

- Recent management changes: On February 16th, Remi Marcoux stepped down as Executive Chairman of the Board and Isabelle Marcoux was elected Chair of the Board; on February 2nd, Alain Gignac was appointed Chief Marketing Activation Officer, a new senior management position with responsibility for the integration of print product and services, print and digital media, and interactive marketing solutions for major accounts; on May 9th, Natalie Larivière resigned as President of TC Media, effective end of June.

- Expanded its digital advertising representation by signing numerous deals and partnerships with Cinoche.com, PoolExpert (R), Hearst Digital Media and Homes Publishing Group as well as acquiring a majority stake in Redux Media, a leading online advertising network. TC Transcontinental now reaches over 18.7 million unique monthly visitors per month in Canada or two thirds of all online Canadians, through more than 3,500 websites.

- Launched a television production house to create content for all communication platforms, from TV channels for general consumption to new Internet and mobile media for on-demand delivery. Also launched FRESH JUICE, a new healthy living media brand in collaboration with Loblaw Companies Limited.

- Broadened its extensive community newspaper network in Quebec by acquiring Édition Beauce and Courrier Frontenac and strengthened its position as the leader in the supplemental educational publishing market in Quebec by the acquisition of the shares of Les Éditions Caractère.

- Launched its third Sustainability Report, based on the Global Reporting Initiative (GRI), an international standard for sustainability methodology. The Report meets Application Level B of the GRI standard. The full web report, a downloadable pdf as well as a highlights brochure are all available at www.tctranscontinental-ecodev.com

Highlights for the Six-month Period

For the first six-month period of fiscal 2012, Transcontinental's revenues increased 1%, from $1,013.5 million to $1,025.3 million. This increase was driven primarily by the acquisition of Quad/Graphics Canada, Inc. and numerous acquisitions and launches of community newspapers in Quebec. This growth was mitigated primarily by the sale of its black and white book printing business, destined for U.S. exports, to Quad/Graphics last September and lower volume from the non-recurring revenue from the printing contract for the Canadian Census last year. Adjusted operating income decreased 9%, from $108.9 million to $98.8 million. This decrease was primarily due to the non-recurrence of the Canadian Census contract, margin erosion from competitive pressures in the local solutions marketplace and new provincial legislation in Quebec under Bill 88 that imposes greater recycling fees on publishers. Net income applicable to participating shares decreased from $58.4 million, or $0.72 per share, to a loss of $139.5 million, or $1.72 per share. This decrease is mainly due to an impairment of assets of $180.8 million, which is non-cash and non-operational and to notices of re-assessment received from the federal and provincial tax authorities last February, totaling $58 million, for which the Corporation is currently contesting. Excluding unusual items and discontinued operations, adjusted net income applicable to participating shares decreased 8%, from $67.9 million, or $0.84 per share, to $62.5 million, or $0.77 per share.

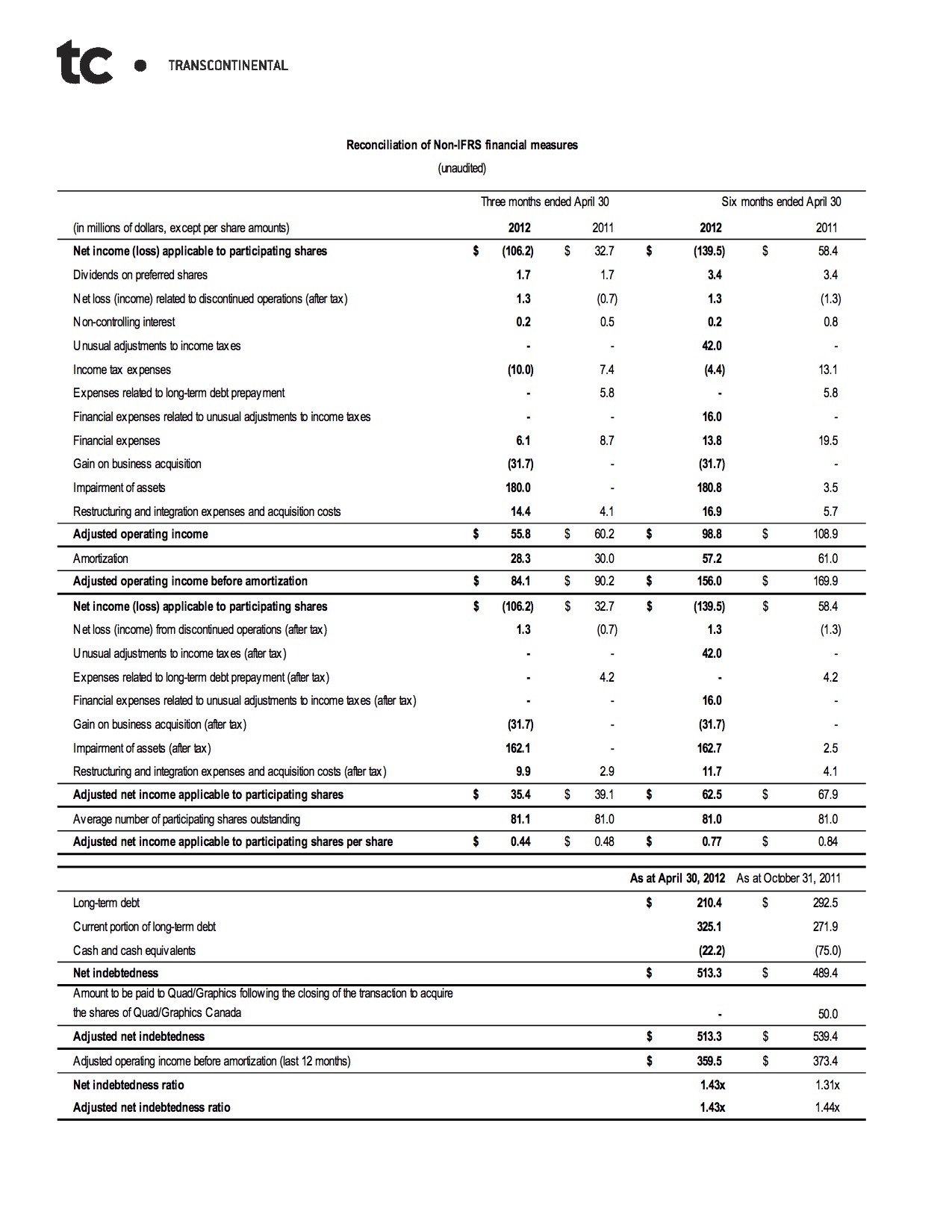

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, Management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividend

At its June 7, 2012 meeting, the Corporation's Board of Directors declared a quarterly dividend of $0.145 per Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on July 20, 2012 to participating shareholders of record at the close of business on July 3, 2012. On an annual basis, this represents a dividend of $0.58 per share. Furthermore, at the same meeting, the Board also declared a quarterly dividend of $0.4196 per share on cumulative 5-year rate reset first preferred shares, series D. This dividend is payable on July 16, 2012. On an annual basis, this represents a dividend of $1.6875 per preferred share.

Additional Information

Upon releasing its second quarter results, Transcontinental Inc. will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are (514) 807-9895 or (647) 427-7450 or 1-888-231-8191 and the access code is: 86629492#. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation's Web site, which will then be archived for 30 days. For media requests for information or interviews, please contact Nancy Bouffard, Director, Internal and External Communications of TC Transcontinental, at 514 954-2809.

Profile

TC Transcontinental creates marketing products and services that allow businesses to attract, reach and retain their target customers. The Corporation is the largest printer in Canada and the fourth-largest in North America. As the leading publisher of consumer magazines and French-language educational resources, and of community newspapers in Quebec and the Atlantic provinces, it is also one of Canada's major media groups. TC Transcontinental is also the leading door-to-door distributor of advertising material in Canada through its Publisac network in Quebec and Targeo in the rest of Canada. Thanks to a wide digital network of more than 3,500 websites, the Corporation reaches over 18.7 million unique visitors per month in Canada. TC Transcontinental also offers interactive marketing products and services that use new communication platforms supported by marketing strategy and planning services, database analytics, premedia, e-flyers, email marketing, custom communications and mobile solutions.

Transcontinental Inc. (TSX: TCL.A, TCL.B, TCL.PR.D), known by the brands TC Transcontinental, TC Media and TC Transcontinental Printing, has approximately 11,000 employees in Canada and the United States, and reported revenues of C$2.0 billion in 2011. For more information about the corporation, please visit www.tc.tc

Forward-looking Statements

This press release contains certain forward-looking statements concerning the future performance of the Corporation. Such statements, based on the current expectations of management, inherently involve numerous risks and uncertainties, known and unknown. We caution that all forward-looking information is inherently uncertain and actual results may differ materially from the assumptions, estimates or expectations reflected or contained in the forward-looking information, and that actual future performance will be affected by a number of factors, many of which are beyond the Corporation's control, including, but not limited to, the economic situation, structural changes in its industries, exchange rate, availability of capital, energy costs, increased competition, as well as the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities. The risks, uncertainties and other factors that could influence actual results are described in the Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2011 and in the Annual Information Form and have been updated in the MD&A for the second quarter ended April 30th, 2012.

The forward-looking information in this release is based on current expectations and information available as at June 7, 2012. The Corporation's management disclaims any intention or obligation to update or revise any forward-looking statements unless otherwise required by the Securities Authorities.

- 30 -

For information:

Media

Nancy Bouffard

Director, Internal and External Communications

TC Transcontinental

Telephone : 514 954 2809

nancy.bouffard@tc.tc

www.tc.tc

Financial Community

Jennifer F. McCaughey

Senior Director, Investor Relations and Financial Communications

TC Transcontinental

Telephone : 514 954 2821

jennifer.mccaughey@tc.tc

www.tc.tc