Transcontinental Inc. announces its results for the third quarter of Fiscal 2015

Highlights

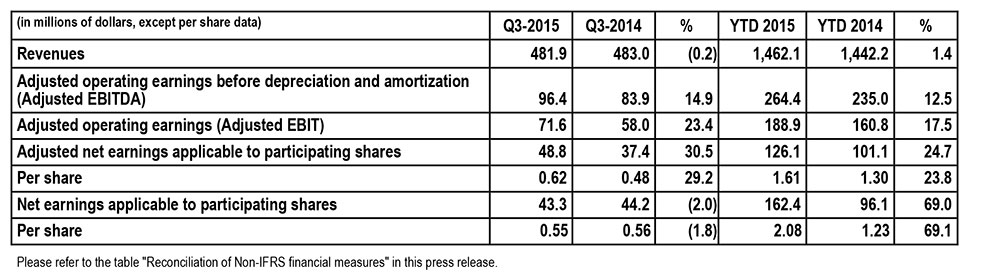

- Revenues were stable at $481.9 million.

- Adjusted operating earnings before depreciation and amortization grew 14.9%.

- Adjusted net earnings applicable to participating shares increased 30.5%.

- Maintained a solid financial position, with a net indebtedness ratio of 0.8x.

- Obtained new contracts in the packaging and printing divisions valued at over $30 million, on an annualized basis, which will progressively come into effect starting in the fourth quarter of 2015.

- Entered into a definitive agreement to acquire Ultra Flex Packaging, a supplier of flexible packaging, located in Brooklyn, New York.

Montreal, September 10, 2015 - Transcontinental inc. (TSX: TCL.A TCL.B) announces its results for the third quarter of Fiscal 2015, which ended July 31, 2015.

"Our results for the third quarter reflect, once again, our ability to implement our strategy that aims at, on the one hand, continuously improving the performance of our core assets and, on the other hand, diversifying in a rational and measured approach our operations into flexible packaging," said François Olivier, President and Chief Executive Officer of TC Transcontinental. "In fact, the changes made to our portfolio of publications, combined with the efforts to optimize our cost structure across the Corporation, contributed to the growth in our profitability despite an advertising market in transformation."

"I am also especially satisfied with the results of our packaging division. In addition to achieving solid growth since the acquisition of Capri Packaging, we have also signed a multi-year agreement with a leader in the North American dairy industry. Furthermore, following our recently announced acquisition of Ultra Flex Packaging, we will continue developing our network in the United States, access new markets and expand our manufacturing capabilities."

"Lastly, we have a sound financial position and keep generating significant cash flows that will allow us to continue our transformation."

2015 Third Quarter Results

Revenues for the third quarter of 2015 went from $483.0 million to $481.9 million. The increase in volume in the packaging division, the printing contracts signed in 2014 and the appreciation of the US dollar against the Canadian dollar had a favourable impact on revenues. These contributions were however offset mainly by the impact of the transformation of the advertising market on the results of certain of the Corporation's niches, in particular on the operations of the Media Sector, which saw a decline in revenues from local and national advertisers. In addition, the loss of certain customers early in the fiscal year continues to have a negative impact on the flyer printing operations.

Adjusted operating earnings went from $58.0 million to $71.6 million in the third quarter of 2015, an increase of 23.4%. This performance is attributable to the increase in volume in the packaging division, the optimization of the cost structure across the Corporation, the favourable impact of the exchange rate and the impact of the decrease in the stock price on the stock-based compensation. It was however mitigated by the above-mentioned factors.

Adjusted net earnings applicable to participating shares grew 30.5%, from $37.4 million, or $0.48 per share, to $48.8 million, or $0.62 per share. This performance is attributable to an increase in adjusted operating earnings before depreciation and amortization and a decrease in net financial expenses. Net earnings applicable to participating shares decreased 2.0%, from $44.2 million, or $0.56 per share, to $43.3 million, or $0.55 per share. This slight decrease results mainly from a favourable adjustment to deferred income tax assets in 2014, partly offset by the improvement in operating earnings.

Other Highlights

- TC Transcontinental obtained several contracts valued at over $30 million, on an annualized basis, which will progressively come into effect starting in the fourth quarter of fiscal 2015:

- Many multi-year contracts for flyer printing, mostly for clients located in Quebec.

- A contract to print Canada's census forms in 2016.

- A multi-year contract in the flexible packaging niche with a leader in the North American dairy industry.

- On September 1, 2015, the Corporation announced that it entered into a definitive agreement to acquire Ultra Flex Packaging Corp., a supplier of flexible packaging, located in Brooklyn, New York, for US$80 million to be paid in cash at closing plus an additional consideration payable subject to attaining pre-established financial targets. Ultra Flex Packaging employs close to 300 people and generated US$72 million in annual revenues and US$12 million in operating income before amortization in its last fiscal year. The transaction is subject to regulatory approval in the United States and is expected to close before the end of our fiscal year.

Highlights for the First Nine Months

For the first nine months of 2015, TC Transcontinental's revenues increased 1.4%, from $1,442.2 million to $1,462.1 million. This increase stems primarily from the contribution of acquisitions, more specifically the acquisition of Capri Packaging and the Quebec weekly newspapers (net of disposals and closures). The signing of new printing agreements in 2014 and the appreciation of the US dollar against the Canadian dollar also had a favourable impact. This increase in revenues was however mitigated mainly by the impact of the transformation of the advertising market on the results of certain of the Corporation's niches, in particular on the weekly newspapers' advertising revenues. Furthermore, the loss of certain customers early in the fiscal year affected the flyer printing operations.

Adjusted operating earnings went from $160.8 million to $188.9 million, an increase of 17.5%. This increase is attributable to the contribution from acquisitions, disposals and closures, the optimization of the cost structure across the Corporation and the favourable impact of the exchange rate. It was however mitigated by the above-mentioned factors and the increase in stock-based compensation expense.

Adjusted net earnings applicable to participating shares grew 24.7%, from $101.1 million, or $1.30 per share, to $126.1 million, or $1.61 per share. Net earnings attributable to participating shares increased from $96.1 million, or $1.23 per share, to $162.4 million, or $2.08 per share. This increase results mainly from the gain on the sale of consumer magazines produced in Montreal and Toronto, the reversal of the provision related to multi-employer pension plans and the increase in operating earnings.

For more detailed financial information, please see Management's Discussion and Analysis for the third quarter ended July 31st, 2015 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook

Flyer printing volume should remain relatively stable and will benefit from new agreements signed with certain retailers that will mitigate the effect of the loss of customers early in the fiscal year. In addition, we will continue to successfully develop our point-of-purchase marketing product offering for retailers. Furthermore, we will continue with our optimization initiatives, which should offset the effect of the transformation of the printing industry that is expected to have an ongoing negative impact, especially on our newspaper, magazine and marketing product printing activities.

The definitive agreement to acquire the shares of Ultra Flex Packaging will allow us to pursue the development of our growth vector in the flexible packaging industry. During its most recent fiscal year, Ultra Flex Packaging generated annual revenues of US$72 million and operating earnings before depreciation and amortization of approximately US$12 million. In addition, the current results of our packaging operations continue to exceed our expectations and the announcement of the signing of a multi-year agreement should enable us to improve our operating earnings in 2016.

Within the Media Sector, the positive impacts of the integration of the weekly newspapers in Quebec should dissipate. Furthermore, we expect that the difficult advertising market conditions will persist and continue to negatively impact our results in the fourth quarter. However, we will continue to review our cost structure to limit the impact on our profit margin and will pursue the development of our digital media offering. Lastly, the sector will also continue to be affected by the exit from the Canadian market by a retailer, which will have a negative effect on our distribution activities.

We will continue to generate significant cash flows in the upcoming quarters, and our excellent financial position should permit us to continue investing in our growth. We will also begin integrating Ultra Flex Packaging into our packaging division, and we will take steps to organically grow our existing operations. In addition, we will maintain our disciplined acquisition approach in this promising market to ensure a sustained long-term growth for the Corporation.

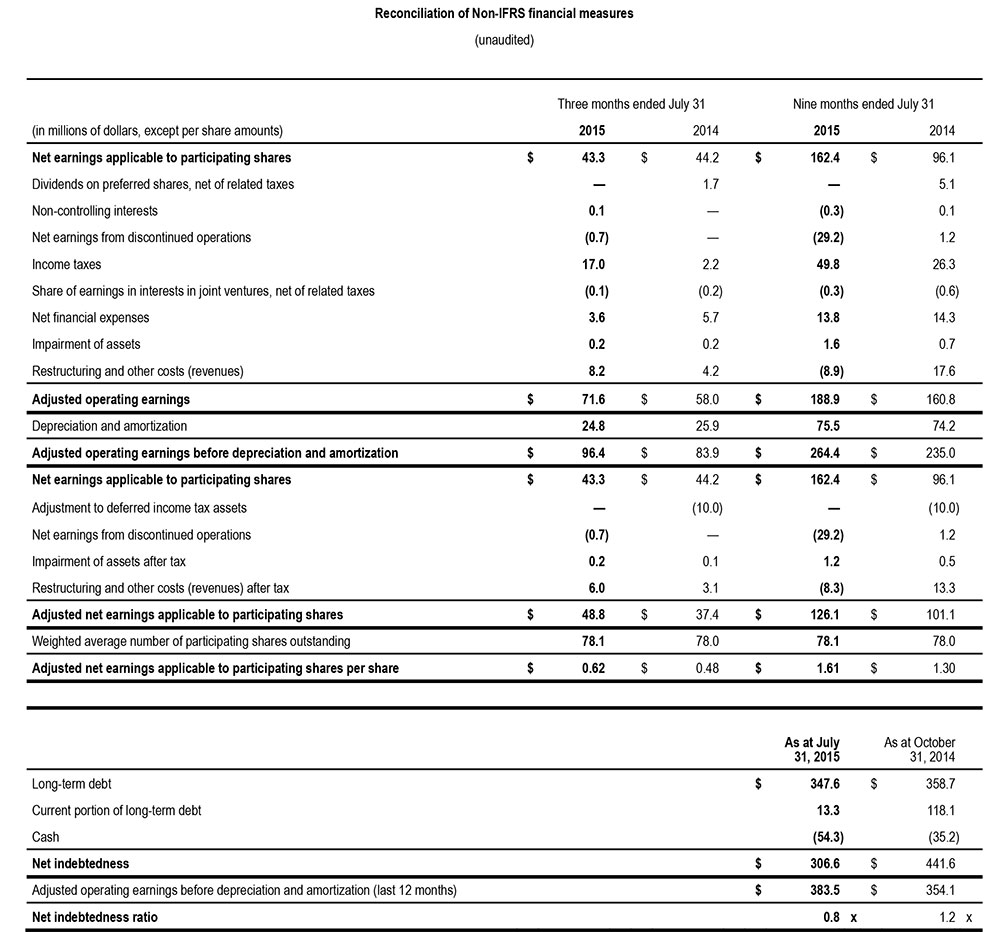

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.17 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on October 21, 2015 to shareholders of record at the close of business on October 5, 2015.

Conference Call

Upon releasing its third quarter 2015 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-in only mode or tune in to the simultaneous audio broadcast on the Corporation's website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514-954-3581.

Profile

Canada's largest printer, with operations in print and digital media, flexible packaging and publishing, TC Transcontinental's mission is to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are strong values held by the Corporation and its commitment to all stakeholders is to pursue its business and philanthropic activities in a responsible manner.

Transcontinental Inc. (TSX: TCL.A TCL.B), known as TC Transcontinental, has over 8,000 employees in Canada and the United States, and revenues of C$2.1 billion in 2014. Website www.tc.tc

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world and particularly in Canada and the United States, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities, the regulatory environment, the safety of its packaging products used in the food industry, innovation of its offering and concentration of its sales in certain segments. The main risks, uncertainties and factors that could influence actual results are described in Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2014, in the latest Annual Information Form and have been updated in the MD&A for the third quarter ended July 31st, 2015.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of nonrecurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of September 10, 2015.

The forward-looking statements in this press release are made pursuant to the "safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at September 10, 2015. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

- 30 -

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate

Communications

TC Transcontinental

Telephone : 514-954-3581

Financial Community

Jennifer F. McCaughey

Senior Director, Investor Relations

and External Communications

TC Transcontinental

Telephone : 514-954-2821