Transcontinental Inc. announces its results for the first quarter of fiscal 2015

Highlights

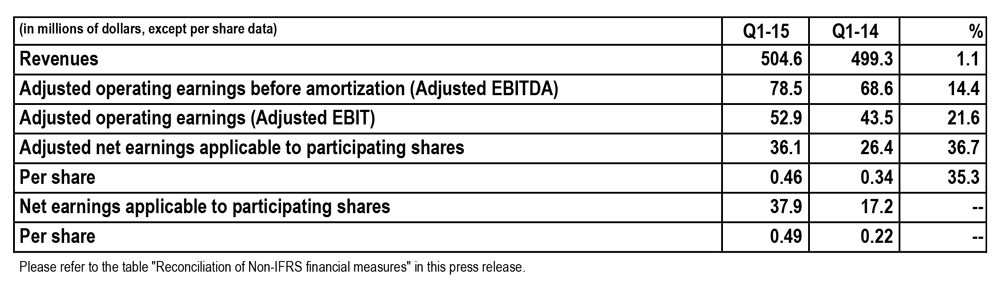

- Revenues increased 1.1%.

- Adjusted net earnings applicable to participating shares grew 36.7%.

- Increased the dividend per participating share by 6%, to $0.68 per year.

- Maintained a solid financial position, with a net indebtedness ratio of 1.24x.

- Announced the sale of consumer magazines produced in Montreal and Toronto to TVA Group Inc. for $55.5 million. The Competition Bureau issued a No Action letter, which clears this transaction. The sale is expected to close in April 2015.

Montreal, March 17, 2015 - Transcontinental Inc. (TSX: TCL.A, TCL.B) announces its results for the first quarter of Fiscal 2015, which ended January 31, 2015.

Message from the President and Chief Executive Officer

"With the results for the first quarter of Fiscal 2015, namely the 1.1% growth in consolidated revenues and the 36.7% increase in our profitability, the year is off to a good start," said François Olivier, President and Chief Executive Officer of TC Transcontinental. "Our strategy aimed at consolidating the weekly newspaper market in Quebec and diversifying into flexible packaging has been fruitful. The integration of Transcontinental Capri was successfully completed, and this asset is performing as expected. Despite lower advertising revenues, our various initiatives allowed us to be profitable and to keep generating significant cash flows. We maintain an excellent financial position, which permits us, once again this year, to increase the dividend per participating share."

"In the coming quarters, we intend to continue growing our flexible packaging business, optimizing our operating activities as well as investing in our digital offering," concluded François Olivier.

2015 First Quarter Results

Revenues for the first quarter of 2015 increased 1.1%, from $499.3 million to $504.6 million. This increase is mainly attributable to the contribution from acquisitions, more specifically the acquisition of Capri Packaging and the Quebec weekly newspapers from Sun Media Corporation. New printing and distribution agreements signed in 2014 also contributed to the increase in revenues. In addition, the appreciation of the US dollar against the Canadian dollar had a favourable impact. This growth in revenues was mitigated by disposals and closures, namely the sale of Rastar's assets, a reduction in marketing products printing activities, a transitional slowdown in flyer printing activities in the United States and, to a lesser extent, in Canada, and challenging market conditions for advertising spending.

In the first quarter of 2015, adjusted operating earnings rose 21.6%, from $43.5 million to $52.9 million. On the one hand, this performance is due to the contribution from acquisitions, disposals and closures as well as the favourable impact of the US dollar versus the Canadian dollar. On the other hand, this increase stems from the new printing and distribution agreements and the cost-reduction initiatives in the Media Sector. However, this growth was partly offset by the above-mentioned lower advertising revenues and the variation in the stock-based compensation expense.

Adjusted net earnings applicable to participating shares grew 36.7%, from $26.4 million to $36.1 million. On a per share basis, it increased from $0.34 to $0.46. Net earnings applicable to participating shares more than doubled, from $17.2 million, or $0.22 per share, to $37.9 million, or $0.49 per share. This improvement results mostly from the increase in operating earnings before amortization compared to the first quarter of 2014.

Other Highlights

- On December 9, 2014, the Corporation extended its credit facility for two additional years, until February 2020.

- On March 17, 2015, the Corporation released its sixth annual Sustainability Report titled "Guide. Mobilize. Achieve." This edition outlines the Corporation's progress with respect to its three-year plan (2013-2015) based on three pillars: the environment, employees and communities. To learn more about the commitments and achievements of TC Transcontinental with respect to corporate social responsibility, refer to the 2014 report, which is on the Corporation's website at www.tc.tc/socialresponsibility.

For more detailed financial information, please see Management's Discussion and Analysis for the first quarter ended January 31st, 2015 as well as the financial statements in the "Investors" section of our website at www.tc.tc

Outlook

We will continue our efforts to maximize the profitability of our printing platform in fiscal 2015. The impact of the new agreements to print newspapers and magazines, announced in 2014, should keep contributing to our operating earnings, and we will maintain our efforts to attract other Canadian newspaper publishers to our highly efficient print network. We will also continue developing solutions to meet the evolving needs of retailers, in particular with respect to our point-of-purchase marketing services. However, a decline in advertising spending should continue to impact our printing operations.

The challenging conditions with respect to advertising revenues should continue to impact our weekly newspaper publishing activities as well as our interactive marketing solutions during fiscal 2015. However, these items should be offset by our synergies related to our two recent transactions within the Media sector. Lastly, we will continue to invest in the development of our digital and interactive marketing products as well as enhance our business and education offerings.

We will continue to generate significant cash flows in the next quarters, and our excellent financial position should permit us to continue applying our multi-pronged capital management approach, which allows us to invest in our growth while increasing our dividends and reducing our debt. The results from our acquisition of Capri Packaging continue to meet our expectations, and we will maintain a disciplined approach to growth opportunities in this niche.

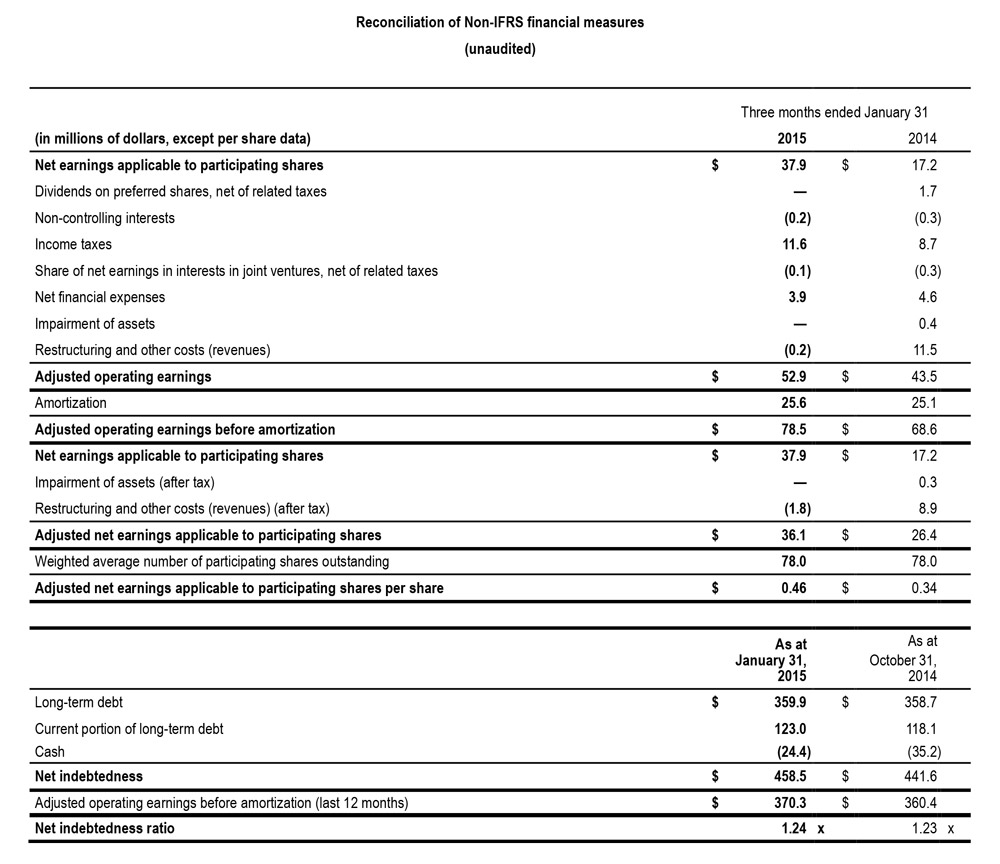

Reconciliation of Non-IFRS Financial Measures

Financial data have been prepared in conformity with IFRS. However, certain measures used in this press release do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many readers analyze our results based on certain non-IFRS financial measures because such measures are more appropriate for evaluating the Corporation's operating performance. Internally, management uses such non-IFRS financial information as an indicator of business performance, and evaluates management's effectiveness with specific reference to these indicators. These measures should be considered in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with IFRS.

The following table reconciles IFRS financial measures to non-IFRS financial measures.

Dividends

Dividend on Participating Shares

The Corporation's Board of Directors declared a quarterly dividend of $0.17 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on April 30, 2015 to shareholders of record at the close of business on April 10, 2015. The Corporation thus increased the dividend per participating share by 6%, or $0.04, raising the annual dividend from $0.64 to $0.68 per share. This increase reflects TC Transcontinental's solid cash flow position.

Additional Information

Annual General Meeting of Shareholders

Transcontinental Inc. will hold its Annual General Meeting of Shareholders today at 2:30 p.m. at the Centre Mont-Royal, 2200 Mansfield Street, Montreal. For those who are unable to attend in person, the Corporation will webcast (audio only) the meeting and post it on it's website at www.tc.tc on March 18.

Conference Call

Upon releasing its first quarter 2015 results, the Corporation will hold a conference call for the financial community today at 9:30 a.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-in only mode or tune in to the simultaneous audio broadcast on the Corporation's website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514-954-3581.

Profile

Canada's largest printer, with operations in print and digital media, publishing and flexible packaging, TC Transcontinental's mission is to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are strong values held by the Corporation and its commitment to all stakeholders is to pursue its business and philanthropic activities in a responsible manner.

Transcontinental Inc. (TSX: TCL.A, TCL.B), known as TC Transcontinental, has over 8,500 employees in Canada and the United States, and revenues of C$2.1 billion in 2014. Website www.tc.tc

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world and particularly in Canada and the United States, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, the Corporation's capacity to engage in strategic transactions and integrate acquisitions into its activities, the regulatory environment, the safety of its packaging products used in the food industry, innovation of its offering and concentration of its sales in certain segments. The main risks, uncertainties and factors that could influence actual results are described in Management's Discussion and Analysis (MD&A) for the fiscal year ended on October 31st, 2014, in the latest Annual Information Form and have been updated in the MD&A for the first quarter ended January 31st, 2015.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of nonrecurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of March 16, 2015.

The forward-looking statements in this press release are made pursuant to the "safe harbour" provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at March 16, 2015. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

- 30 -

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone : 514 954-3581

nathalie.st-jean@tc.tc

Financial Community

Jennifer F. McCaughey

Senior Director, Investor Relations

and External Corporate Communications

TC Transcontinental

Telephone : 514 954-2821

jennifer.mccaughey@tc.tc