On June 12, 2024, the Corporation was authorized to repurchase, for cancellation on the open market, or subject to the approval of any securities authority by private agreements, between June 17, 2024 and June 16, 2025, or at an earlier date if the Corporation concludes or cancels the offer, up to 3,662,967 of its Class A Subordinate Voting Shares and up to 668,241 of its Class B Shares. The repurchases are made in the normal course of business at market prices through the Toronto Stock Exchange.

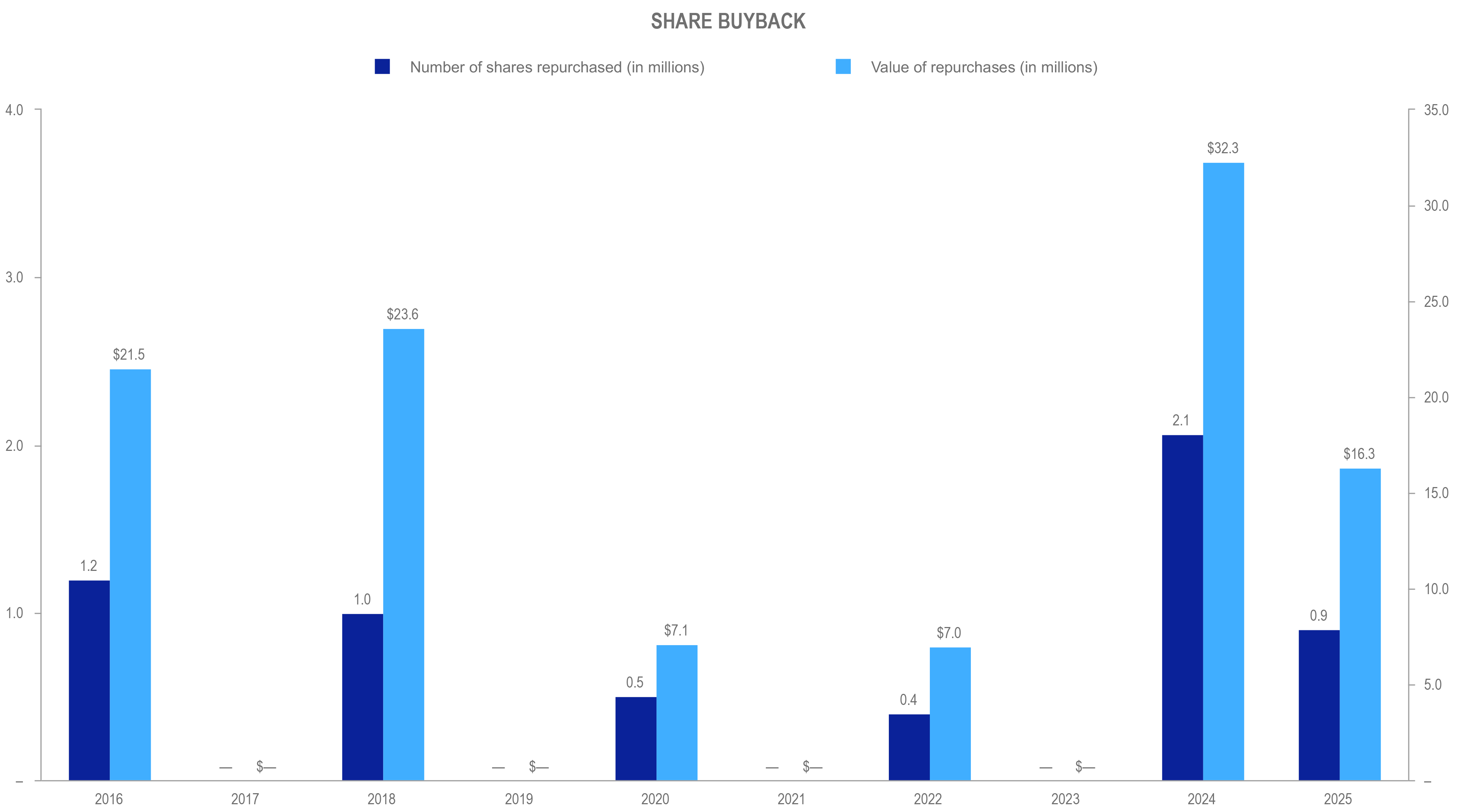

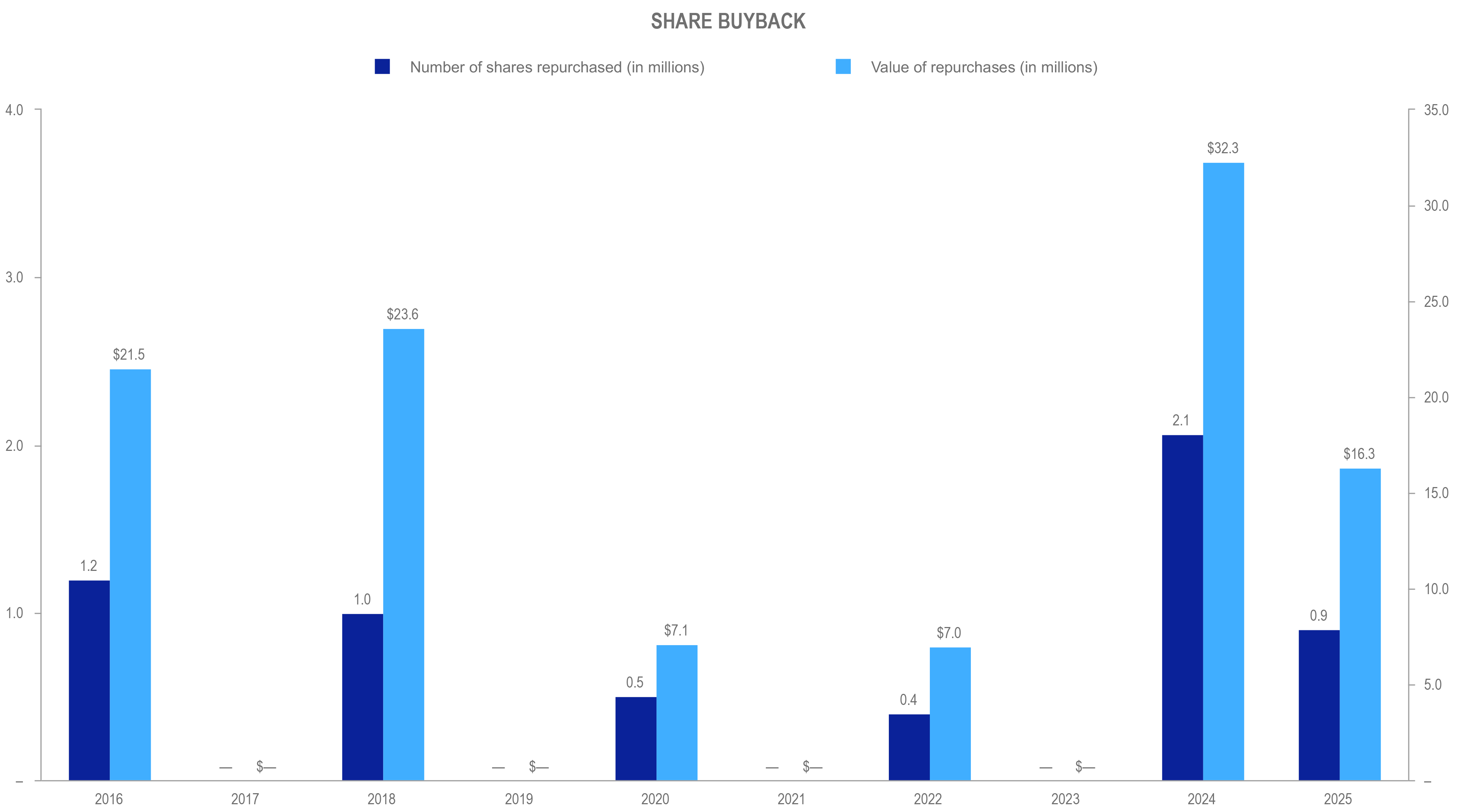

During the first quarter of 2025, as part of its normal course issuer bid, the Corporation repurchased and cancelled 934,434 Class A Subordinate Voting Shares at a weighted average price of $17.38 and 3,600 Class B Shares at a weighted average price of $17.27, for a total cash consideration of $16.3 million.

Note: By fiscal year