Transcontinental Inc. announces its financial results for the second quarter of fiscal 2018

Highlights

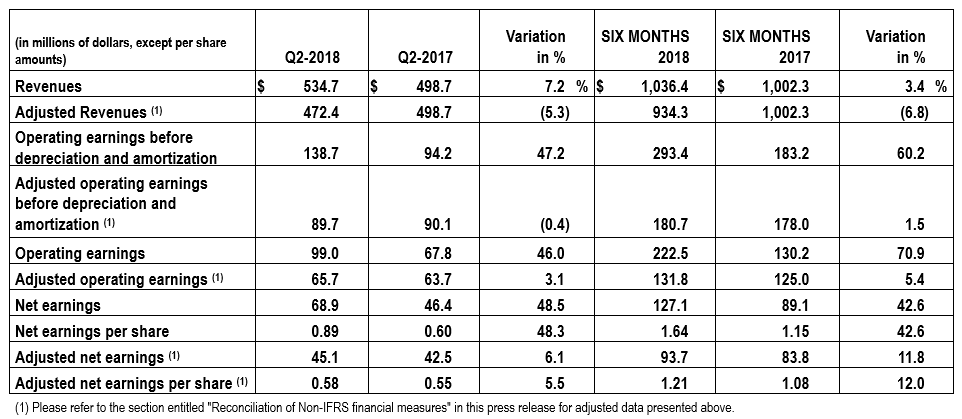

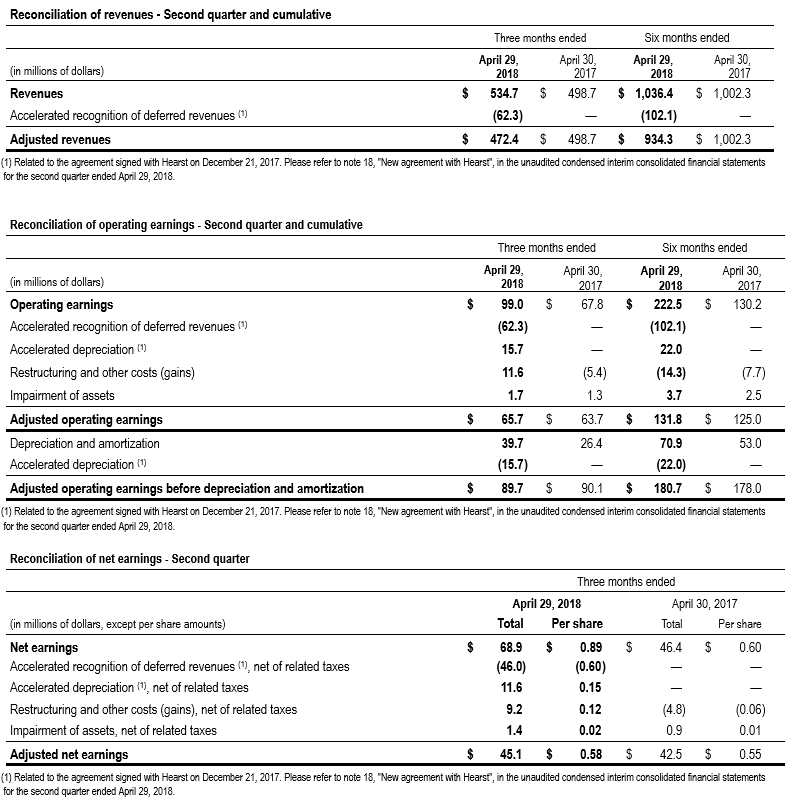

- Revenues increased by $36.0 million, or 7.2%, from $498.7 million to $534.7 million. Adjusted revenues, which exclude an amount of $62.3 million for the accelerated recognition of deferred revenues related to the agreement signed with Hearst in December 2017, decreased by $26.3 million, or 5.3%, to $472.4 million. This decrease is mainly due to the sale of our media assets in Atlantic Canada and of local and regional newspapers in Québec.

- Operating earnings increased by $31.2 million, or 46.0%, from $67.8 million to $99.0 million. Adjusted operating earnings, which exclude an amount of $46.6 million for the accelerated recognition of deferred revenues net of accelerated depreciation related to the agreement signed with Hearst in December 2017, as well as restructuring and other costs (gains) and impairment of assets, increased by $2.0 million, or 3.1%, from $63.7 million to $65.7 million.

- Net earnings increased by $22.5 million, or 48.5%, from $46.4 million to $68.9 million. Adjusted net earnings, which exclude the accelerated recognition of deferred revenues, accelerated depreciation, restructuring and other costs (gains) and impairment of assets, net of related income taxes, increased by $2.6 million, or 6.1%, from $42.5 million to $45.1 million.

- Acquired Multifilm Packaging Corporation, a flexible packaging supplier located in Elgin, Illinois.

- Sold 33 publications, including 32 local newspapers, of which those sold on June 6, 2018, and the Métro Montréal daily newspaper, as well as their related web properties.

- Completed the acquisition of Coveris Americas on May 1, 2018. TC Transcontinental becomes a North American leader in flexible packaging. The Corporation acquired 21 production facilities located in the United States, Canada, Ecuador, Guatemala, Mexico, the United Kingdom, New Zealand and China for US$1.32 billion (C$1.697 billion) and welcomed 3,100 employees. For its fiscal year ended December 31, 2017, Coveris Americas generated US$966 million in revenues (about C$1.26 billion).

- Ranked by Corporate Knights as one of the Best 50 Corporate Citizens in Canada.

Montréal, June 7, 2018 - Transcontinental Inc. (TSX: TCL.A TCL.B) announces its results for the second quarter of fiscal 2018, which ended April 29, 2018.

"Our good performance in the second quarter demonstrates that our strategic decisions in our three business lines contributed to the strong results for our entire portfolio, said François Olivier, President and Chief Executive Officer of TC Transcontinental. We are therefore in an excellent position to begin a new phase of our growth plan with enthusiasm and conviction.

"During the quarter, we positioned ourselves as a North American leader in flexible packaging with the transformational acquisition of Coveris Americas. This is a pivotal point in our evolution as our packaging division is now the largest division in terms of our pro forma revenues. This transaction is in addition to the acquisition of Multifilm Packaging, in Illinois, which was completed in March.

"The printing division experienced a stable quarter, and certain initiatives implemented to optimize our platform continued to bear fruit. In our Media Sector, we are very pleased with the results of the sale process of local publications. All titles in Québec are now owned by local players, and the vast majority of jobs were maintained. We only have one local newspaper remaining to be sold in Ontario.

"Supported by these results and our solid financial position, we begin the integration of Coveris Americas with confidence. We expect to continue generating significant cash flows, which should enable us to reduce our net indebtedness, while pursuing our growth strategy in packaging."

Financial Highlights

2018 Second Quarter Results

Revenues increased by $36.0 million, or 7.2%, from $498.7 million in the second quarter of 2017 to $534.7 million in the corresponding period in 2018. Excluding the $62.3 million favourable effect of the accelerated recognition of deferred revenues related to the agreement signed with Hearst in December 2017, adjusted revenues went from $498.7 million in the second quarter of 2017 to $472.4 million in the corresponding period in 2018, a decrease of 5.3%. However, excluding the unfavourable impact of the sale of newspapers and other media assets in 2017 related to the Corporation's strategy, as well as the unfavourable exchange rate effect, adjusted revenues increased by $7.1 million, or 1.5%. This increase is mostly attributable to the contribution from the acquisitions of Les Industries Flexipak and Multifilm Packaging as well as the organic growth in revenues in the packaging division due to the increase in volume in all our plants. In the printing division, revenues from our service offering to Canadian retailers slowed down slightly. The decline in revenues from the other printing division verticals continued as a result of the same trends in the advertising market as well as the end of the printing of The Globe and Mail in the Maritimes, of La Presse and of the San Francisco Chronicle as of April 1, partially offset by additional volume in the marketing products vertical.

Operating earnings increased by $31.2 million, or 46.0%, from $67.8 million in the second quarter of 2017 to $99.0 million in the second quarter of 2018. This increase in mostly attributable to the favourable effect of the accelerated recognition of deferred revenues and the decrease in operating expenses resulting from the sale of media assets and cost reduction initiatives. This increase was partially offset, mainly, by the increase in restructuring and other costs (gains) and the effect of accelerated depreciation. Adjusted operating earnings increased by $2.0 million, or 3.1%, from $63.7 million in the second quarter of 2017 to $65.7 million in the second quarter of 2018.

Excluding the unfavourable impact of the sale of newspapers and other media assets in 2017 and the unfavourable exchange rate effect, adjusted operating earnings increased by $5.5 million, or 9.1%. This increase is mostly attributable to the organic growth in adjusted operating earnings as a result of the favourable effect of cost reduction initiatives Corporation-wide, partially offset by the above-mentioned decreases in volume. This quarter, the change in the stock-based compensation expense as a result of the change in the share price in the second quarter of 2018 compared to the corresponding period in 2017 and the change in exchange rates had no material impact on operating earnings.

Net earnings increased by $22.5 million, or 48.5%, from $46.4 million in the second quarter of 2017 to $68.9 million in the second quarter of 2018. This increase is mostly attributable to the growth in operating earnings, partially offset by higher income taxes. On a per share basis, net earnings went from $0.60 to $0.89. Excluding the accelerated recognition of deferred revenues, accelerated depreciation, restructuring and other costs (gains) and impairment of assets, net of related income taxes, adjusted net earnings increased by $2.6 million, or 6.1%, from $42.5 million in the second quarter of 2017 to $45.1 million in the second quarter of 2018. This increase is attributable to the growth in adjusted operating earnings, as explained above. On a per share basis, adjusted net earnings went from $0.55 to $0.58.

2018 First Six Months Results

Revenues increased by $34.1 million, or 3.4%, from $1,002.3 million in the first six months of 2017 to $1,036.4 million in the corresponding period in 2018. Excluding the $102.1 million favourable effect of the accelerated recognition of deferred revenues related to the agreement signed with Hearst in December 2017, adjusted revenues went from $1,002.3 million in the first six months of 2017 to $934.3 million in the same period in 2018, a decrease of 6.8%. However, excluding the unfavourable impact of the sales of newspapers and other media assets in 2017 related to the Corporation's strategy, as well as the unfavourable exchange rate effect, adjusted revenues remained relatively stable. The decrease in revenues from verticals that are not related to services to retailers as a result of the same trends in the advertising market and the end of the printing of The Globe and Mail in the Maritimes and of La Presse, as well as the decrease in revenues from unsold newspapers in the local and regional newspaper publishing niche in Québec and Ontario in the first six months of 2018, were offset by the stable demand for our retailer-related services, the contribution from the acquisitions of Les Industries Flexipak and Multifilm Packaging and the organic growth in revenues in the packaging division.

Operating earnings increased by $92.3 million, or 70.9%, from $130.2 million in the first six months of 2017 to $222.5 million in the corresponding period in 2018. This increase is mostly attributable to the favourable effect of the accelerated recognition of deferred revenues, the decline in operating expenses, higher gains on the sale of certain activities in the Media Sector and net gains on the sale of buildings, partially offset by the effect of accelerated depreciation. Adjusted operating earnings increased by $6.8 million, or 5.4%, from $125.0 million to $131.8 million. Excluding the stock-based compensation expense, which decreased by $6.8 million as a result of the change in the share price in the first six months of 2018 compared to the corresponding period in 2017, the unfavourable impact of the sale of newspapers and other media assets in 2017 and the unfavourable exchange rate effect, adjusted operating earnings increased by $5.6 million, or 4.4%. This increase is mostly attributable to the organic growth in adjusted operating earnings as a result of the favourable effect of Corporation-wide cost reduction initiatives, partially offset by the above-mentioned decreases in volume.

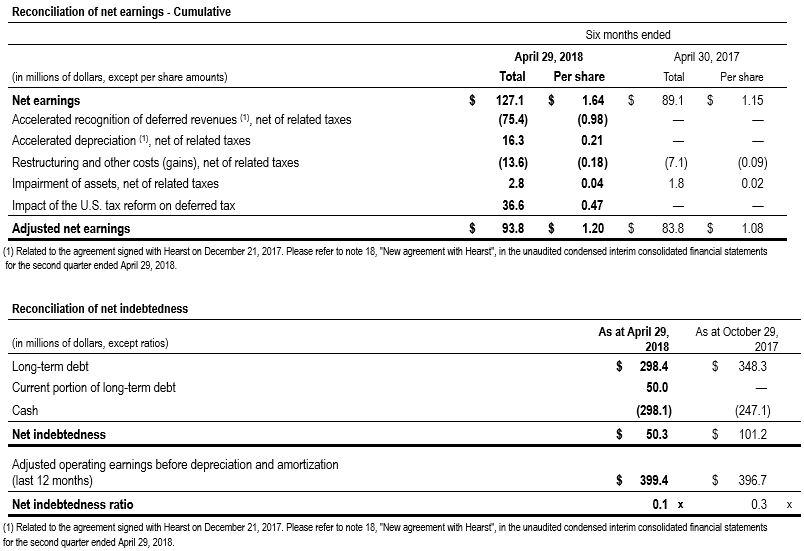

Net earnings increased by $38.0 million, or 42.6%, from $89.1 million in the first six months of 2017 to $127.1 million in the corresponding period in 2018. This increase is mostly attributable to the growth in operating earnings, partially offset by higher income taxes. On a per share basis, net earnings went from $1.15 to $1.64. Excluding the accelerated recognition of deferred revenues, accelerated depreciation, restructuring and other costs (gains) and impairment of assets, net of related income taxes, as well as the impact of the U.S. tax reform on deferred taxes, adjusted net earnings increased by $9.9 million, or 11.8%, from $83.8 million in the first six months of 2017 to $93.7 million in the corresponding period in 2018. On a per share basis, adjusted net earnings went from $1.08 to $1.21.

Subsequent Events

Acquisition of Coveris Americas, issuance of shares and new financing

On May 1, 2018, the Corporation announced that it had completed the acquisition of Coveris Americas previously held by Coveris Holdings S.A. Headquartered in Chicago, Illinois, Coveris Americas manufactures a variety of flexible plastic and paper products, including rollstock, bags and pouches, coextruded films, shrink films, coated substrates and labels. For its fiscal year ended December 31, 2017, Coveris Americas generated US$966 million in revenues, operating earnings of US$68 million and adjusted operating earnings before depreciation and amortization of US$128 million.

TC Transcontinental adds 21 well-invested production facilities in the United States, Canada, Ecuador, Guatemala, Mexico, the United Kingdom, New Zealand and China to its network of 7 flexible packaging plants. With this acquisition, TC Transcontinental leads a network of 28 packaging plants and positions itself as a North American leader in flexible packaging. The Corporation also welcomes 3,100 employees, the majority of whom are located in North America and Latin America.

The purchase consideration is $1,697.0 million (US$1,320.0 million), subject to customary adjustments for working capital and the bearing of certain liabilities at the acquisition date, for a net purchase consideration of $1,567.0 million (US$1,219.0 million). At the acquisition date, the Corporation financed the purchase consideration as well as the acquisition costs out of a combination of 1) cash on hand for an amount of $290.0 million, 2) an amount drawn from existing credit facilities of approximately $167.0 million; 3) an amount drawn from new credit facilities of approximately $964.0 million (US$750.0 million); 4) and the net proceeds of a bought deal public offering of subscription receipts for an amount of $276.0 million.

For more detailed financial information, please see the Management’s Discussion and Analysis for the second quarter ended April 29, 2018 as well as the financial statements in the “Investors” section of our website at www.tc.tc.

Outlook for 2018

In the printing division, we expect revenues from our service offering to Canadian retailers to remain relatively stable in fiscal 2018 compared to the same period in 2017, considering the already announced renewal of our multi-year agreement with the Loblaw Companies Limited. This agreement includes the full range of our retailer-related services as well as additional volume for in-store marketing product printing, premedia services and commercial printing. In all the other printing verticals, we expect that our revenues will continue to be affected by a decline in volume caused by the same trends in the advertising market. We also stopped printing the San Francisco Chronicle as of April pursuant to the agreement signed with Hearst in December 2017. Therefore, we will no longer have the accelerated recognition of deferred revenues and consequently the net effect of this agreement on revenues will be a decrease of approximately $25 million and the net effect on operating earnings will be a decline of approximately $7 million in the second half of this fiscal year compared to the same period in 2017, substantially all of which will have no impact on cash flows. Lastly, to partially offset the decline in volume, we will continue with our operational efficiency initiatives and will benefit from the closure of a plant located in Montréal, which occurred at the end of the first quarter of 2018.

In our packaging division, our acquisitions, in particular Coveris Americas, Multifilm Packaging and Les Industries Flexipak, will contribute to the fiscal 2018 results. During the second half of the fiscal year, we will proceed with the integration of Coveris Americas and start achieving the anticipated synergies. We also rely on our sales force to continue developing our sales funnel and we expect other sales to materialize in order to achieve organic sales growth similar to 2017 for our pre-Coveris Americas acquisition portfolio. We expect Coveris Americas' revenues to be similar to those in 2017. We intend to report the financial data of the packaging division separately from those of the printing division as of the third quarter of 2018.

In the Media Sector, we expect revenues from our activities in the Business and Education niche to remain stable. Furthermore, as our entire Québec local newspaper portfolio has been sold, we plan to continue adjusting our cost structure accordingly.

To conclude, we expect to continue generating significant cash flows from all our operating activities, which should enable us to reduce our net indebtedness.

Reconciliation of Non-IFRS Financial Measures

The financial information has been prepared in accordance with IFRS. However, financial measures used, namely the adjusted revenues, the adjusted operating earnings, the adjusted operating earnings before depreciation and amortization, the adjusted net earnings, the adjusted net earnings per share, the net indebtedness and the net indebtedness ratio, for which a complete definition is presented in the Management's Discussion and Analysis for the second quarter ended April 29, 2018, and for which a reconciliation is presented in the following table, do not have any standardized meaning under IFRS and could be calculated differently by other companies. We believe that many of our readers analyze the financial performance of the Corporation’s activities based on these non-IFRS financial measures as such measures may allow for easier comparisons between periods. These measures should be considered as a complement to financial performance measures in accordance with IFRS. They do not substitute and are not superior to them.

We also believe that the adjusted revenues, the adjusted operating earnings before depreciation and amortization, the adjusted operating earnings, that takes into account the impact of past investments in property, plant and equipment and intangible assets, and the adjusted net earnings are useful indicators of the performance of our operations. Furthermore, management also uses some of these non-IFRS financial measures to assess the performance of its activities and managers.

Regarding the net indebtedness and net indebtedness ratio, we believe that these indicators are useful to measure the Corporation’s financial leverage and ability to meet its financial obligations.

Dividend

The Corporation's Board of Directors declared a quarterly dividend of $0.21 per share on Class A Subordinate Voting Shares and Class B Shares. This dividend is payable on July 11, 2018 to shareholders of record at the close of business on June 28, 2018.

Conference Call

Upon releasing its second quarter 2018 results, the Corporation will hold a conference call for the financial community today at 4:15 p.m. The dial-in numbers are 1 647 788-4922 or 1 877 223-4471. Media may hear the call in listen-only mode or tune in to the simultaneous audio broadcast on the Corporation’s website, which will then be archived for 30 days. For media requests or interviews, please contact Nathalie St-Jean, Senior Advisor, Corporate Communications of TC Transcontinental, at 514 954-3581.

Profile

TC Transcontinental is a leader in flexible packaging in North America, and Canada’s largest printer. The Corporation is also a Canadian leader in its specialty media segments. For over 40 years, TC Transcontinental's mission has been to create products and services that allow businesses to attract, reach and retain their target customers.

Respect, teamwork, performance and innovation are strong values held by the Corporation and its employees. TC Transcontinental's commitment to its stakeholders is to pursue its business activities in a responsible manner.

Transcontinental Inc. (TSX: TCL.A TCL.B), known as TC Transcontinental, has over 9,000 employees, the majority of which are based in Canada, the United States and Latin America. TC Transcontinental had revenues of approximately C$2.0 billion for the fiscal year ended October 29, 2017. The Corporation has completed, on May 1, 2018, the transformational acquisition of Coveris Americas which generated approximately C$1.26 billion in revenues (US$966 million) for its fiscal year ended December 31, 2017. For more information, visit TC Transcontinental's website at www.tc.tc.

Forward-looking Statements

Our public communications often contain oral or written forward-looking statements which are based on the expectations of management and inherently subject to a certain number of risks and uncertainties, known and unknown. By their very nature, forward-looking statements are derived from both general and specific assumptions. The Corporation cautions against undue reliance on such statements since actual results or events may differ materially from the expectations expressed or implied in them. Forward-looking statements may include observations concerning the Corporation's objectives, strategy, anticipated financial results and business outlook. The Corporation's future performance may also be affected by a number of factors, many of which are beyond the Corporation's will or control. These factors include, but are not limited to, the economic situation in the world, structural changes in the industries in which the Corporation operates, the exchange rate, availability of capital, energy costs, competition, the Corporation's capacity to engage in strategic transactions and effectively integrate acquisitions into its activities without affecting its growth and its profitability, while achieving the expected synergies, the political, social, regulatory and legislative environment, in particular with regard to the environment and sustainable development, the safety of its packaging products used in the food industry, innovation of its offering, the protection of its intellectual property rights, concentration of its sales in certain segments, cybersecurity and data protection, recruiting and retaining qualified personnel in certain geographic areas and industry sectors, taxation, interest rate and net indebtedness level. The main risks, uncertainties and factors that could influence actual results are described in the Management's Discussion and Analysis (MD&A) for the fiscal year ended October 29, 2017 and in the latest Annual Information Form, and have been updated in the MD&A for the second quarter ended April 29, 2018.

Unless otherwise indicated by the Corporation, forward-looking statements do not take into account the potential impact of nonrecurring or other unusual items, nor of divestitures, business combinations, mergers or acquisitions which may be announced after the date of June 7, 2018.

The forward-looking statements in this press release are made pursuant to the “safe harbour” provisions of applicable Canadian securities legislation.

The forward-looking statements in this release are based on current expectations and information available as at June 7, 2018. Such forward-looking information may also be found in other documents filed with Canadian securities regulators or in other communications. The Corporation's management disclaims any intention or obligation to update or revise these statements unless otherwise required by the securities authorities.

– 30 –

For information:

Media

Nathalie St-Jean

Senior Advisor, Corporate Communications

TC Transcontinental

Telephone: 514-954-3581

nathalie.st-jean@tc.tc

www.tc.tc

Financial Community

Shirley Chenny

Advisor, Investor Relations

TC Transcontinental

Telephone: 514-954-4166

shirley.chenny@tc.tc

www.tc.tc